UK Public Liability Insurance Minimum Cover (2025): What SMEs Should Carry

Meta Description: Understand the minimum public-liability insurance cover UK SMEs should hold in 2025 — typical limits, contract demands and budget-friendly strategies.

1️⃣ Introduction

Public liability insurance protects UK businesses from third-party claims for injury or property damage caused during operations. In 2025, while no law mandates a specific minimum limit, contractual obligations and client expectations make adequate coverage essential. For small-to-medium enterprises (SMEs), the right balance between premium cost and protection level ensures compliance and peace of mind.

2️⃣ Purpose of public liability cover

Public liability insurance provides financial protection when a business is held responsible for third-party harm — such as a customer slipping on premises or damage caused during onsite work. It covers legal fees, compensation payments, and associated costs, helping maintain business continuity and credibility. Many landlords, councils, and clients require proof of cover before allowing work to commence.

3️⃣ Typical minimum limits by sector

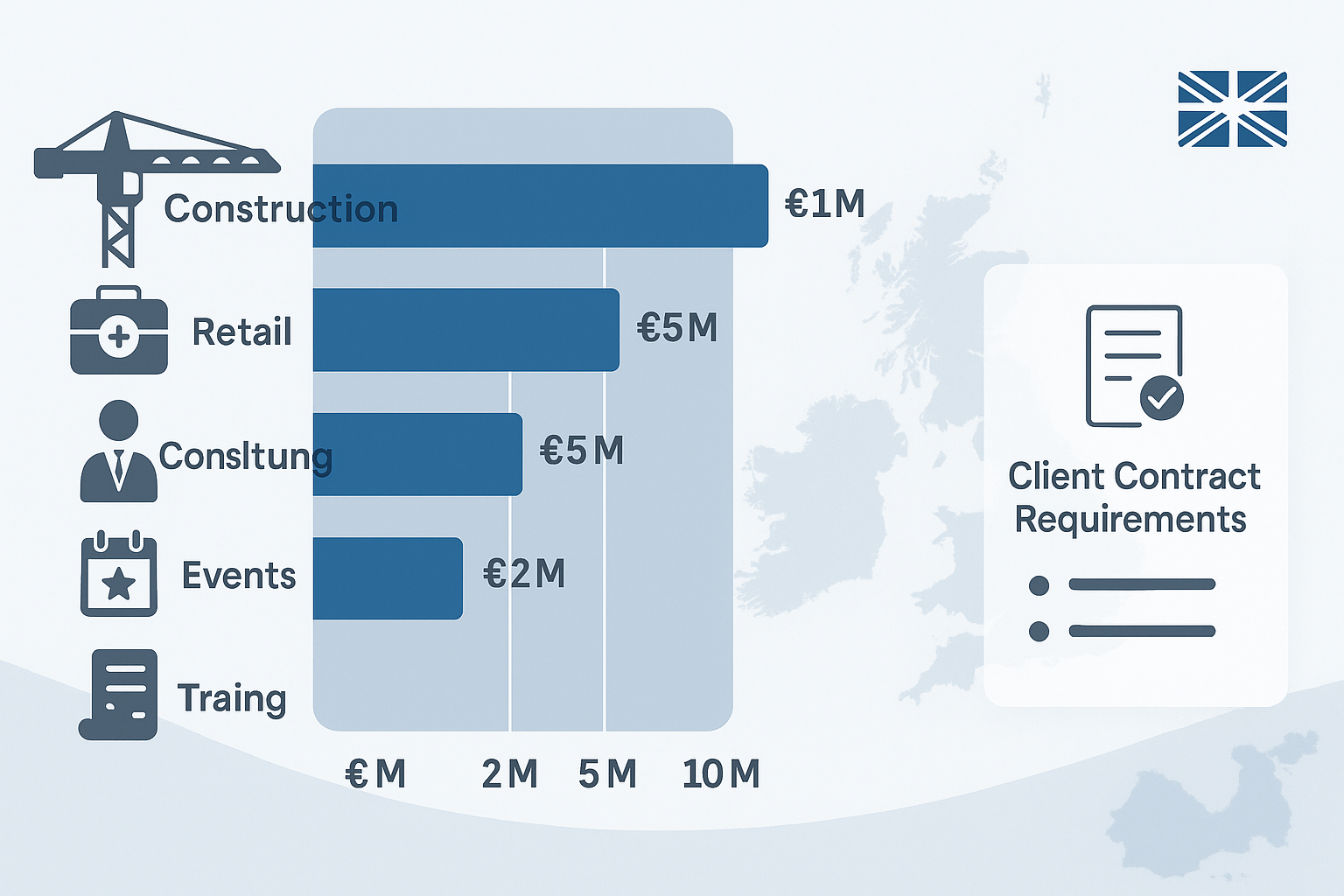

Although there’s no statutory minimum in the UK, most sectors operate within common coverage expectations. The limit reflects the potential size of third-party losses and contractual demands.

| Sector | Typical Minimum Limit (2025) | Notes |

|---|---|---|

| Retail / Hospitality | £2 million | Often required by landlords or public venues |

| Construction / Trades | £5 million | Public-sector or local authority contracts may demand higher limits |

| Professional Services | £1–£2 million | Depends on client premises access and operational risk |

| Events & Entertainment | £5–£10 million | Large crowd exposure or council permits often increase requirements |

4️⃣ Contractual requirements vs legal minimums

There is no legal minimum for public liability insurance in the UK; however, many contracts, especially government or construction-related, specify coverage thresholds. Public authorities often require at least £5 million of cover, while smaller private contracts may accept £1 million. Businesses should always check tender or lease agreements, as non-compliance can invalidate work eligibility or result in breach of contract.

5️⃣ Cost-benefit: limit selection & excess trade-offs

Higher coverage limits provide better financial protection but increase premiums. SMEs can manage costs by adjusting the policy excess — the amount paid toward a claim before the insurer contributes. For example, increasing excess from £250 to £500 can reduce premiums by 5–10%. The goal is to align cover limits with operational risk, not just the cheapest quote.

6️⃣ How to shop smart for SMEs

To secure budget-friendly and compliant cover in 2025:

- Compare multiple UK insurers and brokers specializing in SME policies.

- Review client or council contract clauses before purchasing cover.

- Bundle liability, property, and professional indemnity insurance for savings.

- Review cover annually to adjust for inflation and business growth.

- Keep accurate safety records — good risk management can lower renewal costs.

FAQs

Q1. Is there a legal minimum limit in the UK?

A1. No fixed legal limit — requirements are usually dictated by clients, contracts, or local authorities.

Q2. Will £1 million cover me?

A2. Often sufficient for low-risk trades or small contracts, but some sectors and councils demand £2–£5 million or more.

Q3. Can I adjust cover per project?

A3. Yes — many insurers allow policy adjustments or endorsements for specific contracts or temporary higher limits.

Conclusion

In 2025, while the UK sets no statutory minimum for public liability insurance, SMEs must align their coverage with sector norms, contract requirements, and realistic exposure to risk. Regularly reviewing limits and comparing insurer options ensures both affordability and compliance with client standards.

References

- HSE — Business Insurance Guidance

- GOV.UK — Business Insurance Overview

- MoneyHelper — Business Insurance Explained