UK Private Health Insurance Cost (2025): Plan Types & Price Trends

In 2025 the average private medical insurance (PMI) premium in the UK is around **£79.59 per month for an individual** — roughly £955 per year — though the actual cost depends heavily on age, cover level and location. :contentReference[oaicite:0]{index=0}

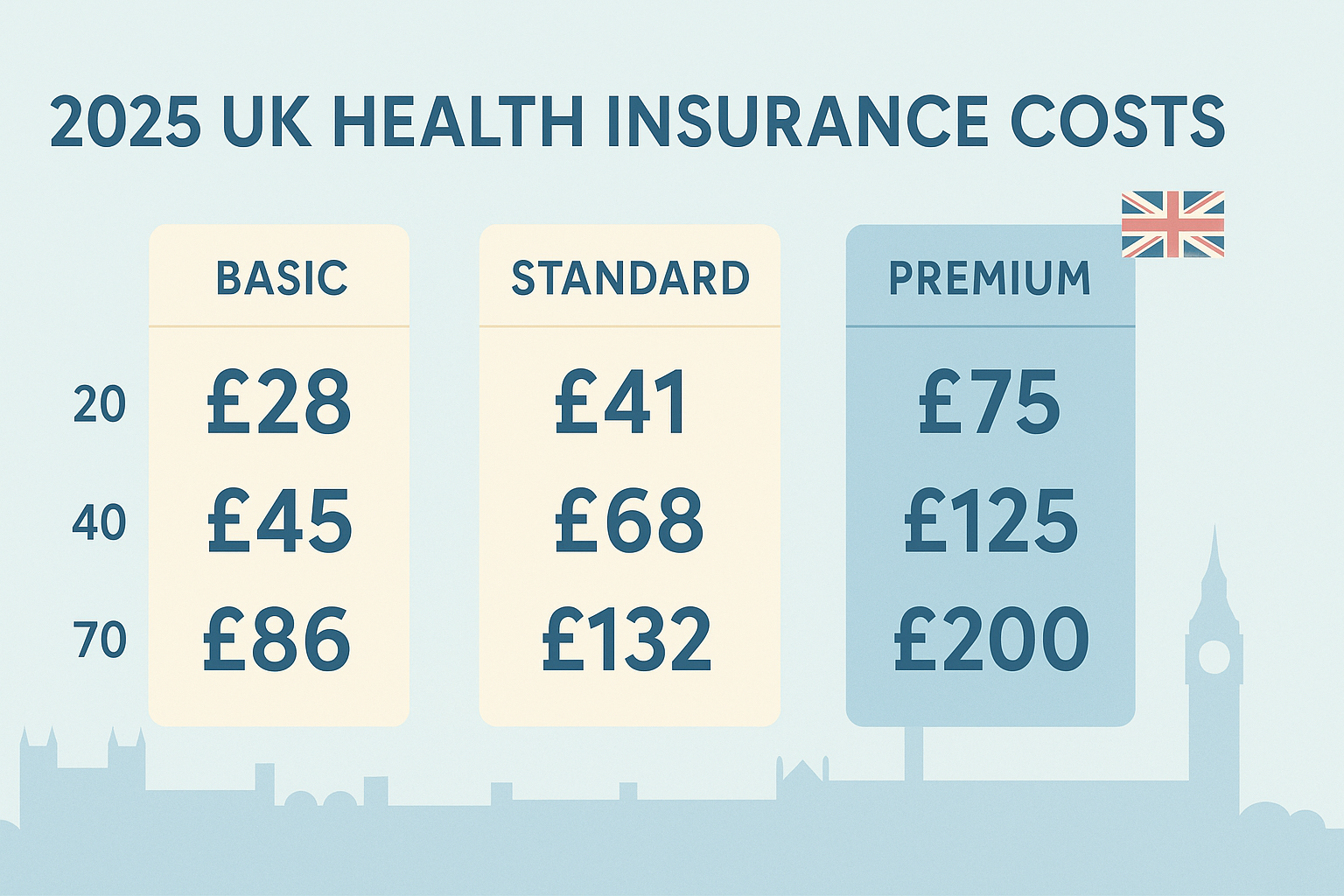

Typical plan tiers (basic, standard, premium)

The UK private health insurance market generally offers three broad tiers of cover:

- Basic / Treatment-Only Cover – Covers inpatient treatment but may exclude outpatient/diagnostic services. Example: a 20-year-old may pay about £28 / month for such cover. :contentReference[oaicite:1]{index=1}

- Standard Cover – Includes inpatient + significant outpatient/diagnostic benefits, often moderate excess. Example: a 40-year-old may pay around £68 / month for standard comprehensive cover. :contentReference[oaicite:2]{index=2}

- Premium / Comprehensive Cover – Includes widest benefits: outpatient, diagnostics, therapies, lower excess, higher choice of consultants/hospitals. Example: for a 70-year-old, the monthly premium may reach ~£200.60. :contentReference[oaicite:3]{index=3}

Primary cost drivers: age, region, pre-existing conditions

Several key factors significantly influence the cost of UK private health insurance:

- Age: Premiums rise steadily with age. For instance, entry-level cover for a 20-year-old may be ~£28/month; for a 60-year-old ~£86/month for basic cover. :contentReference[oaicite:4]{index=4}

- Region / postcode: Where you live matters. London and surrounding areas often pay ~20-30% more than the national average. :contentReference[oaicite:5]{index=5}

- Health history / pre-existing conditions: Insurers may exclude pre-existing conditions, apply loadings or limit benefits. Premiums for healthy individuals will be lower. :contentReference[oaicite:6]{index=6}

- Cover level & benefits: More benefits (outpatient, therapies, large hospital network) = higher cost. Excess and optional add-ons also change cost. :contentReference[oaicite:7]{index=7}

- Market cost inflation: Private medical treatment costs are projected to rise ~10.4% in 2025, putting upward pressure on premiums. :contentReference[oaicite:8]{index=8}

What’s included vs excluded

Understanding what your policy includes (and doesn’t) is essential to judge value:

- Included: Private hospital inpatient treatment, choice of consultant/specialist, sometimes diagnostics and outpatient depending on cover tier.

- May be excluded or limited: Pre-existing conditions, some mental-health therapies, dental/optical, specialist drugs not on NHS list, long-term chronic illness cover, excess payment obligations. :contentReference[oaicite:9]{index=9}

- Excess and benefit limits matter — for example a higher excess will lower your premium but increases your out-of-pocket cost if you claim. :contentReference[oaicite:10]{index=10}

How to compare cost-vs-benefit

Before selecting a plan, consider the following to ensure you get value:

- Compare the same benefit levels (inpatient/outpatient, excess, consultant network) across quotes rather than just the lowest price.

- Evaluate the potential cost of waiting for NHS care vs the premium you pay — faster access may justify a higher premium for some. :contentReference[oaicite:11]{index=11}

- Check what happens on renewal — initial premiums may be low but renewals often increase, especially after claims or as you age. :contentReference[oaicite:12]{index=12}

- Consider your health-risk profile: if you’re young and healthy you might prioritise a lower cost/basic cover; if older or with higher risk you may lean toward higher coverage.

Tips to manage premium increases

To keep your private health-insurance cost under control in 2025 and beyond:

- Pick a higher excess — this reduces the premium if you’re prepared to accept more out-of-pocket risk. :contentReference[oaicite:13]{index=13}

- Limit optional extras (e.g., reduce outpatient or therapy benefits) if you mostly rely on the NHS for those.

- Compare insurers at renewal — switching may yield savings if your health situation hasn’t changed.

- Check for discounts — family plans, multi-policy discounts, non-smoker discounts. :contentReference[oaicite:14]{index=14}

- Review whether you still need PMI if you’re very healthy and willing to use NHS only — the value proposition may shift.

Frequently Asked Questions

Does private insurance replace NHS?

Usually not — private health insurance in the UK is designed to complement the National Health Service (NHS), offering faster access or choice rather than replacing NHS care entirely. :contentReference[oaicite:16]{index=16}

Can pre-existing conditions be excluded?

Yes — many insurers either exclude pre-existing conditions or apply loadings/increased premiums. Always check policy terms carefully. :contentReference[oaicite:17]{index=17}

Is a higher premium always better?

Not necessarily — a higher premium means more benefits, but you still need to ensure those benefits match your needs. Paying more for cover you don’t use may not be efficient. :contentReference[oaicite:18]{index=18}

Key Takeaways

- For 2025 UK private health insurance, expect average individual premiums around **£80/month**, but your actual cost depends heavily on age, region and cover level. :contentReference[oaicite:19]{index=19}

- Choosing the right tier — basic, standard or premium — is critical so you pay for what you need, not just the headline price.

- With treatment-cost inflation and rising demand for private care, premiums are under upward pressure — manage costs via excesses, selective benefits and smart comparison. :contentReference[oaicite:20]{index=20}

References

- myTribe – Average Cost of Private Health Insurance UK (2025) :contentReference[oaicite:21]{index=21}

- Bupa UK – How Much is Private Health Insurance? :contentReference[oaicite:22]{index=22}

- Premier PMI – How Much Is Private Health Insurance (2025) :contentReference[oaicite:23]{index=23}

- Drewberry – Private Health Insurance Cost Calculator UK 2025 :contentReference[oaicite:24]{index=24}

- Healthcare & Protection – UK market premium growth projection 2025 :contentReference[oaicite:25]{index=25}