Cash Home Buyers: How They Work, Pros & Cons Explained

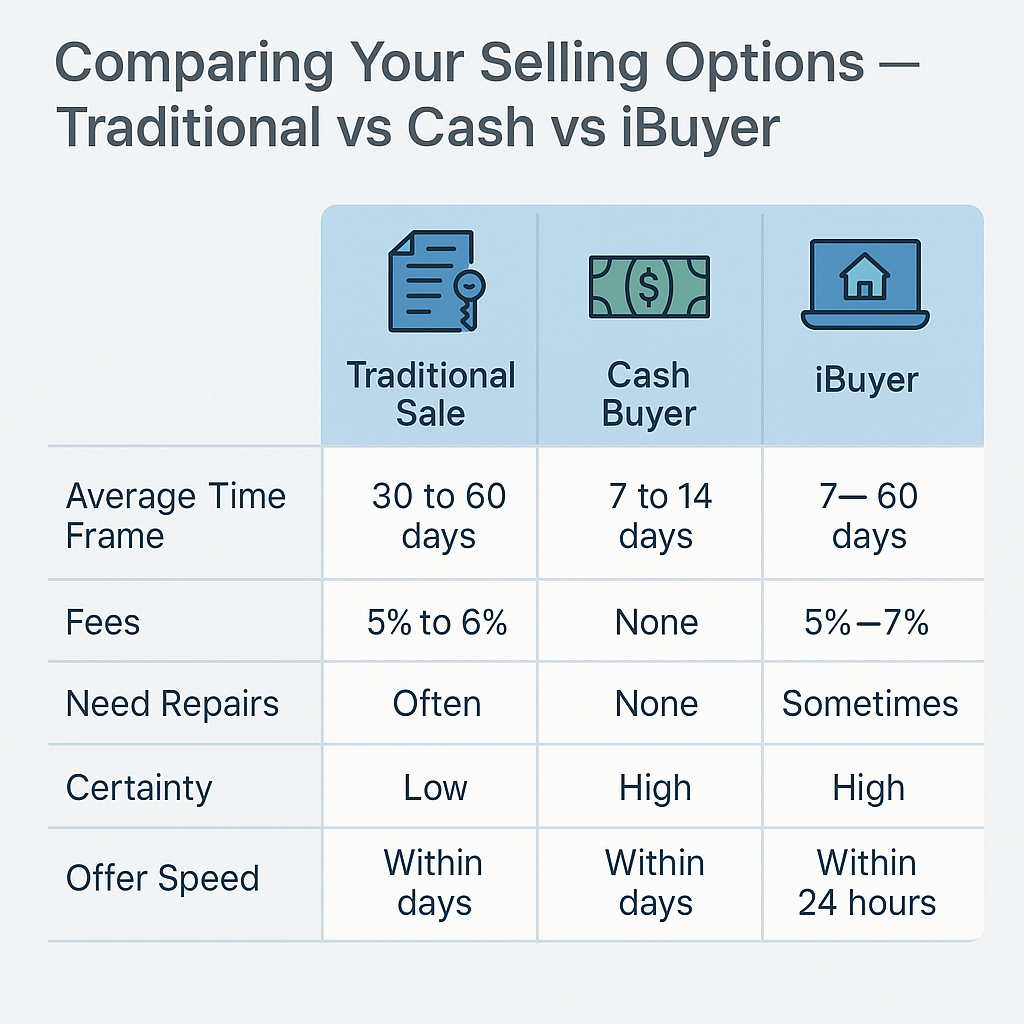

Selling a home can be a long and stressful process — from finding a realtor to dealing with mortgage delays and inspections. But in recent years, cash home buyers have changed the game. These investors or companies purchase homes directly with cash, often closing deals in days instead of months. For homeowners looking to sell quickly or avoid repair costs, this option can be incredibly appealing.

What Are Cash Home Buyers?

A cash home buyer is an individual or a company that purchases a property outright, without needing a mortgage or bank financing. Because they use their own funds, they can move faster and avoid the delays associated with traditional buyers who rely on loan approvals. Many cash home buyers are real estate investors, house-flipping companies, or “we buy houses” services that specialize in quick transactions.

Common Types of Cash Buyers

- Real Estate Investors: Individuals or groups purchasing homes to renovate and resell.

- House Flippers: Buyers who make cosmetic or structural upgrades for profit.

- Instant Buyers (iBuyers): Tech-based companies offering algorithm-driven cash offers, such as Opendoor or Offerpad.

- Buy-and-Hold Investors: Buyers purchasing homes to rent out long-term.

How the Cash Home Buying Process Works

The process is far simpler than a traditional home sale. Here’s a breakdown of what typically happens:

1. Request an Offer

Homeowners contact a cash buyer or fill out an online form with property details. The buyer reviews market data and comparable sales to determine a fair cash offer.

2. Receive the Cash Offer

The buyer presents a no-obligation cash offer within 24–48 hours. This offer usually reflects the home’s current “as-is” value — meaning you don’t need to fix or upgrade anything.

3. Accept and Sign

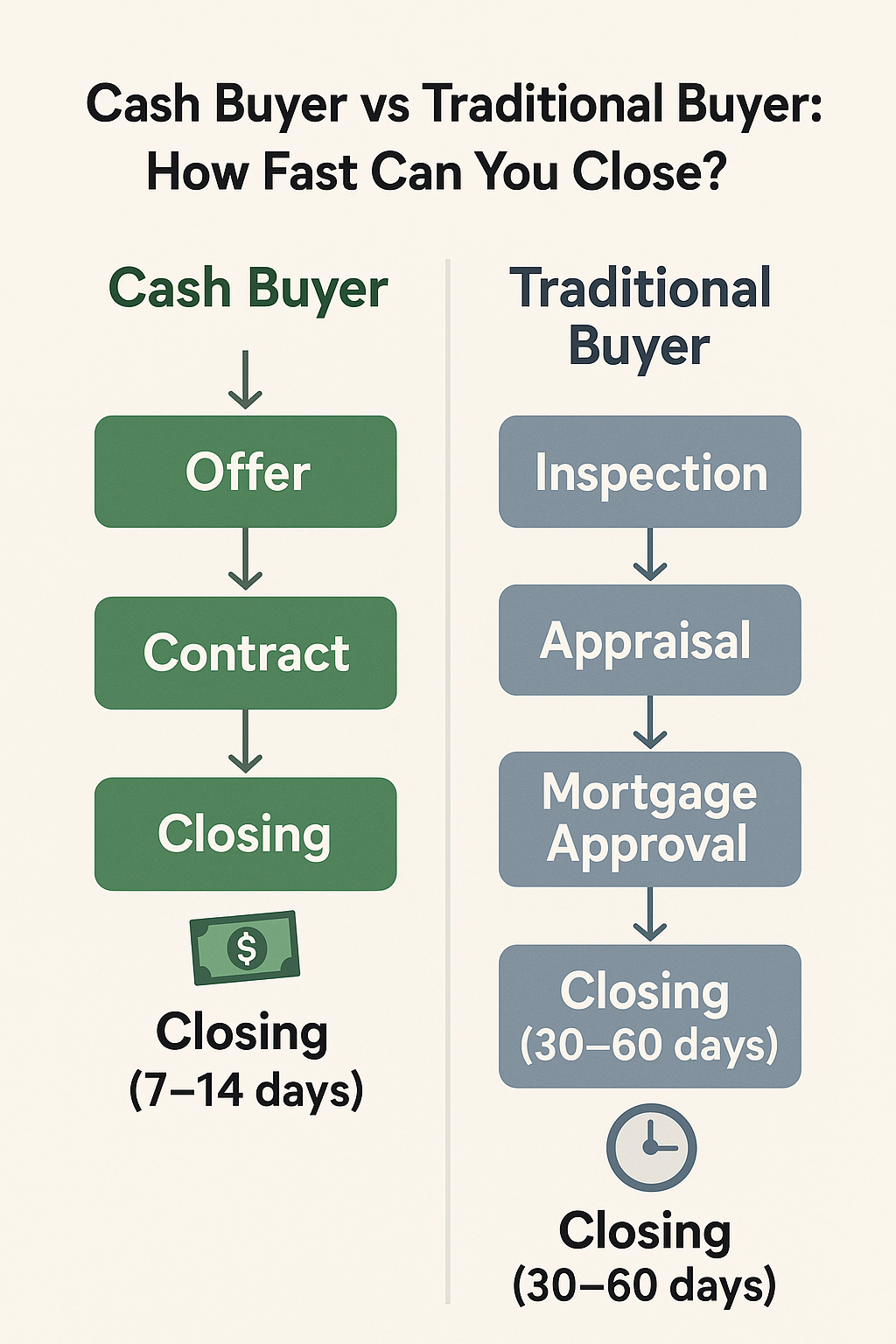

If the seller agrees, both parties sign a purchase agreement. Because there’s no lender involved, there’s no financing contingency or appraisal delays.

4. Close the Deal

Closing can happen in as little as 7–14 days. The seller receives the payment in full, typically through a certified check or wire transfer.

Pros of Selling to Cash Home Buyers

- Fast Closings: No waiting for mortgage approvals or lengthy inspections. Great for urgent situations like relocation, inheritance, or foreclosure.

- Sell As-Is: No need for repairs, cleaning, or staging — buyers take the property in its current condition.

- No Realtor Commissions: Sellers save 5–6% in agent fees by dealing directly with buyers.

- Fewer Uncertainties: With no financing risks, deals rarely fall through.

Cons of Selling to Cash Home Buyers

- Lower Sale Price: Cash buyers typically offer below market value, since they need room for profit margins or renovation costs.

- Scam Risks: Some unlicensed buyers or fake companies exploit desperate sellers. Always verify credentials and read contracts carefully.

- Limited Market Competition: Without multiple offers, sellers may miss opportunities for higher bids.

- Less Emotional Value: Cash buyers treat properties as investments, not as future homes — which can feel impersonal to sellers.

When Selling for Cash Makes Sense

Cash home sales make the most sense when time, convenience, and certainty are your top priorities. Situations where cash buyers are ideal include:

- Facing foreclosure or financial hardship

- Inheriting a property you don’t want to manage

- Dealing with divorce or relocation

- Owning a property in poor condition or with code violations

How to Choose a Reputable Cash Buyer

Before signing anything, research potential buyers carefully. Here’s how to protect yourself:

- Check Reviews and Ratings: Look up Google, Yelp, or BBB ratings for legitimacy.

- Ask for Proof of Funds: A genuine cash buyer should show a recent bank statement or certified letter of available funds.

- Get Everything in Writing: Avoid verbal promises — ensure all terms are in a formal contract.

- Consult a Real Estate Attorney: A short legal review can prevent long-term problems.

Conclusion — Should You Sell Your Home for Cash?

Selling your home to a cash buyer offers unmatched speed and simplicity, especially if you’re in a time-sensitive situation. However, you’ll likely trade some equity for that convenience. The best approach is to compare multiple offers, research the buyer’s reputation, and decide what matters most — maximum price or maximum peace of mind.

For homeowners who value certainty, selling to a reputable cash buyer can be a stress-free solution that gets you to your next chapter faster.

Sources:

– National Association of Realtors (2025 Market Insights)

– Zillow Research (2025)

– U.S. Department of Housing and Urban Development (HUD, 2025)