Texas Auto Insurance Cost (2025): What Drivers Should Expect

In 2025, drivers in Texas should expect to pay around $2,500 – $2,900 per year for full-coverage auto insurance on average. That’s roughly $200 – $240 per month, depending on driving record, vehicle, and location. Minimum coverage policies remain cheaper but provide far less protection.

Current average premiums in Texas

Average 2025 rates from multiple sources show variation by profile and insurer:

- Experian (2025): Full coverage ≈ $2,802/year; minimum ≈ $1,535/year.

- Insure.com: Full coverage ≈ $2,631/year; minimum ≈ $620/year.

- ValuePenguin: Full coverage ≈ $2,184/year (≈ $182/month).

For most Texas drivers, planning for about $2,500/year (~$210/month) is realistic for full coverage. Minimum liability may cost between $600–$1,500/year.

Primary cost drivers (age, vehicle, driving history)

- Age: 20-year-old ≈ $5,000/year vs. 40-year-old ≈ $2,600/year.

- Vehicle type: Luxury or high-repair cars cost more to insure.

- Driving record: One violation can raise rates by 15–20%.

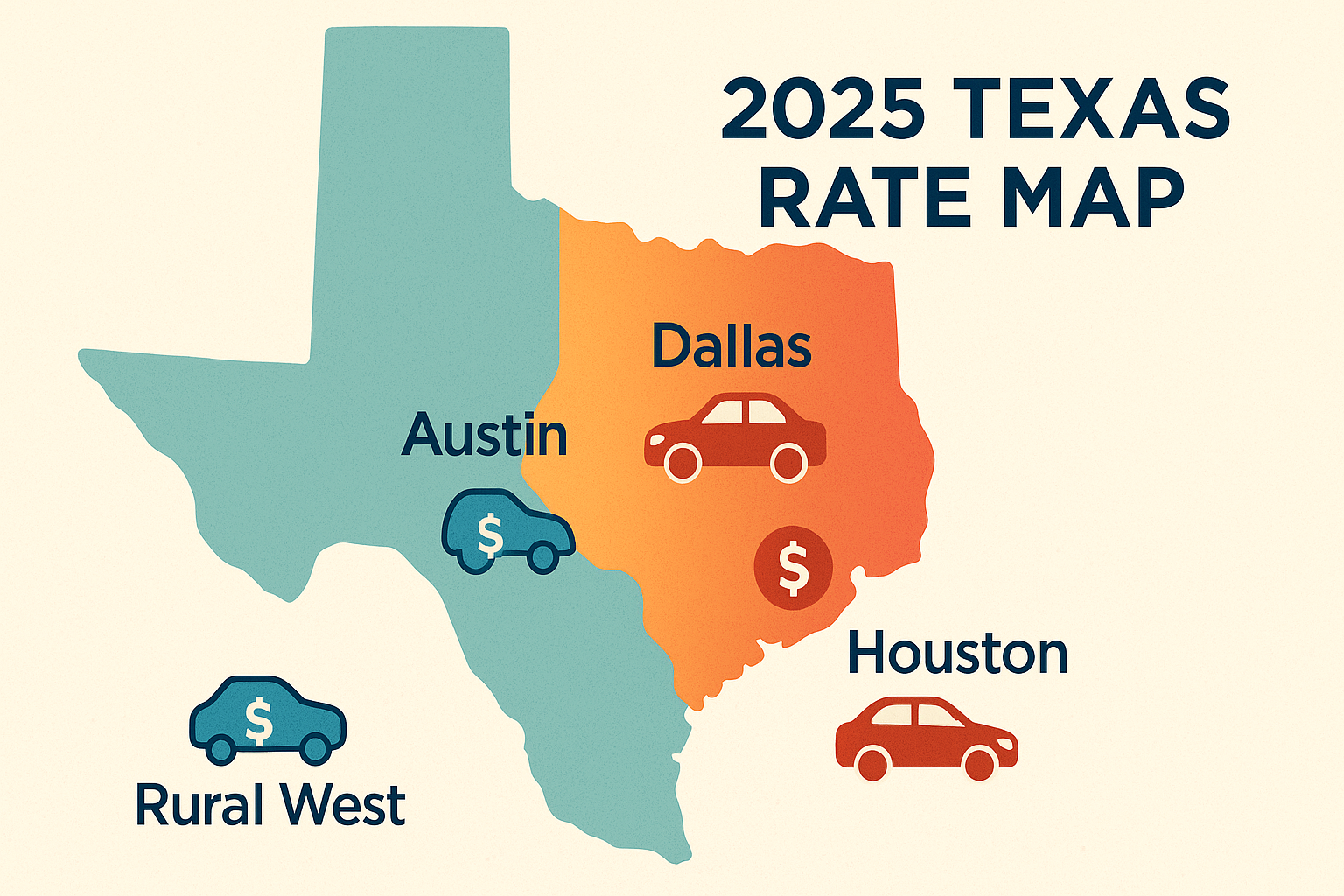

- Location: Houston ≈ $2,696/year vs. Austin ≈ $2,151/year.

- Credit score: Excellent credit may lower rates below $1,500/year.

Minimum required cover vs full coverage

| Coverage Type | What It Covers | Typical Annual Cost (2025) |

|---|---|---|

| Minimum Liability | Legal minimum protection for injuries & property damage to others | $600 – $1,500/year |

| Full Coverage | Includes liability, collision & comprehensive (covers your vehicle too) | $2,500 – $3,000/year |

Case Study 1: 40-year-old Austin driver, clean record → ~$2,300/year.

Case Study 2: 25-year-old Houston driver, 1 violation → ~$3,000/year.

Case Study 3: 55-year-old rural driver, liability only → ~$700/year.

Discount opportunities & bundling

- Bundle auto + home/renters for 5–15% savings.

- Enroll in safe-driver or telematics programs.

- Increase deductibles for lower monthly cost.

- Maintain excellent credit history.

- Re-quote policies each renewal cycle to stay competitive.

When to re-shop your policy

Shop for new quotes annually or after major changes (vehicle purchase, move, traffic violation, etc.). Many Texas drivers save $300–$600/year by switching insurers at renewal.

Frequently Asked Questions

How often should I shop for a new quote?

At least annually or when major life or vehicle changes occur.

Does my driving record affect my cost?

Yes — accidents or violations increase premiums by 15–20% on average.

Is full coverage always worth it on older cars?

Not always; if your car’s value is low, liability-only coverage may be more cost-effective.

What is the minimum legal coverage in Texas?

Bodily injury: $30,000 per person / $60,000 per accident; property damage: $25,000 per accident.

Will my city affect my premium?

Yes — Houston and Dallas average 20% higher premiums than Austin or rural ZIP codes.

Key Takeaways

- Average full-coverage in Texas (2025): $2,500–$2,900/year.

- Minimum liability: ~$600–$1,500/year.

- Main cost drivers: age, record, vehicle, and location.

- Bundle and re-shop annually to save up to 15%.

References