California Business Interruption Insurance Cost (2025): Rates & Risk Factors

Meta Description: Explore business interruption insurance cost in California for 2025 — average rates, key triggers (fire, supply-chain, pandemic) and how to optimize your policy.

1️⃣ Introduction

Business interruption (BI) insurance remains a key safeguard for California companies in 2025, protecting against income loss due to operational disruptions. From wildfires to supply-chain delays, the state’s unique risk profile makes this coverage vital for business continuity. Understanding cost variables and claim readiness can help organizations maintain stability during unforeseen downtime.

2️⃣ What business interruption cover is and why it matters

BI insurance compensates businesses for lost income and operating expenses following covered events such as fire, flood, or equipment breakdown. It bridges the gap between physical damage and financial recovery. Policies typically activate when property damage prevents normal operations, ensuring rent, payroll, and fixed costs are covered during recovery periods.

3️⃣ Common triggers and claims history

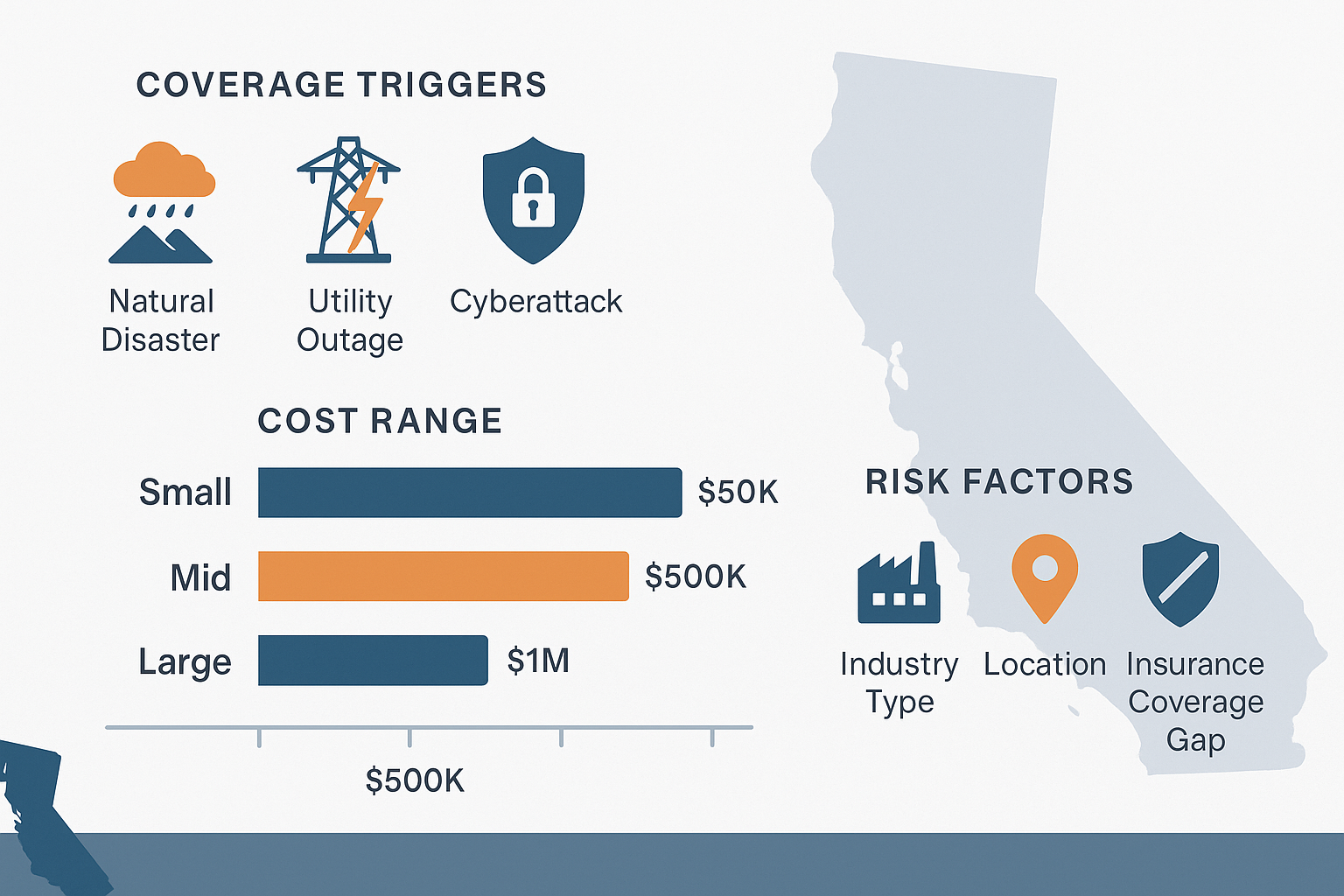

California’s exposure to wildfires, earthquakes, and utility outages drives a high demand for BI coverage. While property damage is the most common trigger, some policies extend to civil authority shutdowns or dependent supplier failures. However, pandemic-related claims remain heavily restricted following COVID-19 litigation, with most 2025 policies excluding infectious disease losses unless purchased as a specific rider.

| Trigger Type | Coverage Availability | Notes |

|---|---|---|

| Fire / Smoke Damage | ✔ Common | Standard inclusion for property-linked BI |

| Utility / Power Interruption | Optional | Requires endorsement in many California policies |

| Supply-Chain Disruption | Conditional | Available under contingent BI extensions |

| Pandemic / Disease | Rare | Usually excluded post-COVID unless added explicitly |

4️⃣ Premium drivers: revenue, risk exposure, recovery time

California BI insurance costs depend on industry risk, location, annual revenue, and the estimated time needed for recovery. Average premiums in 2025 range between $750 and $3,500 per $100,000 of insured gross income for small-to-medium enterprises. Businesses in wildfire-prone or seismic zones often face surcharges. Key pricing factors include:

- Revenue scale: Higher turnover increases potential loss exposure.

- Physical risk profile: Urban vs. rural wildfire zones significantly impact rates.

- Indemnity period: 12-month policies cost less than extended 24-month coverage.

- Business continuity planning: Documented recovery procedures can lower premiums.

5️⃣ Ways to reduce cost: continuity planning, layered cover

Businesses can manage premiums through proactive planning and customized coverage structures. Establishing a strong continuity plan with backup suppliers, offsite data storage, and temporary workspace arrangements reduces insurer risk perception. Layered insurance — splitting limits between multiple carriers — may also control cost for firms with high exposure or complex operations.

6️⃣ Claim readiness: documentation, downtime modelling

Effective claim management depends on detailed financial documentation and accurate downtime modelling. Keeping updated records of revenue, operating expenses, and supplier dependencies enables faster claim validation. Conducting scenario analyses — such as fire or equipment failure simulations — helps estimate potential loss periods and refine coverage adequacy.

FAQs

Q1. Does BI cover pandemics by default?

A1. Often excluded or restricted — most 2025 policies require a specific endorsement for communicable-disease coverage.

Q2. How long is typical indemnity period?

A2. Most California policies provide 12- to 24-month indemnity options, depending on industry and recovery expectations.

Q3. Does supply-chain disruption count?

A3. Sometimes — coverage may apply if contingent business-interruption extensions are purchased.

Conclusion

In 2025, business interruption insurance remains essential for California firms facing wildfire, seismic, and supply-chain risks. By understanding coverage triggers, optimizing limits, and maintaining solid recovery planning, businesses can minimize losses and ensure financial resilience during operational downtime.

References

- California Department of Insurance (Official Site)

- MoneyGeek — Business Insurance Data 2025

- Insurance Information Institute (III) — Business Interruption Insights