Best AI Robo-Advisors for Stock Investing in 2025 — Smart Wealth Automation Guide

AI-powered investing has transformed how individuals build wealth in 2025. Whether you’re in Korea or abroad, AI-driven robo-advisors now make it easier to automate portfolio management, minimize risk, and earn consistent returns — even if you’re not a financial expert. This guide explores the best AI-based robo-advisors available, how they work, and what to consider before investing.

1. Top AI-Powered Robo-Advisors (2025)

| Platform | Key Features | Things to Consider |

|---|---|---|

| Fount (Korea) | Leading Korean AI robo-advisor using data-driven ETF optimization and asset rebalancing. | Check annual fees, minimum investment, and your risk tolerance before committing. |

| Korea Investment & Securities “MY AI” | AI recommendation system integrated into the KIS mobile app for customized portfolio suggestions. | Still experimental; verify whether it’s advisory-only or fully managed. |

| MoFin (Korea) | AI-driven wealth management platform offering personalized investment planning. | Review historical returns, transparency, and exit flexibility. |

| Betterment (U.S.) | Global leader in low-cost robo-advisors with automated rebalancing and tax optimization. | Check taxation and FX implications for international users. |

| Schwab Intelligent Portfolios (U.S.) | Zero-advisory-fee portfolio automation with cash balance management. | High cash allocation may reduce equity exposure. |

| Fidelity Go (U.S.) | Trusted, beginner-friendly robo-advisor by Fidelity with professional portfolio design. | Limited customization and higher minimum deposits apply. |

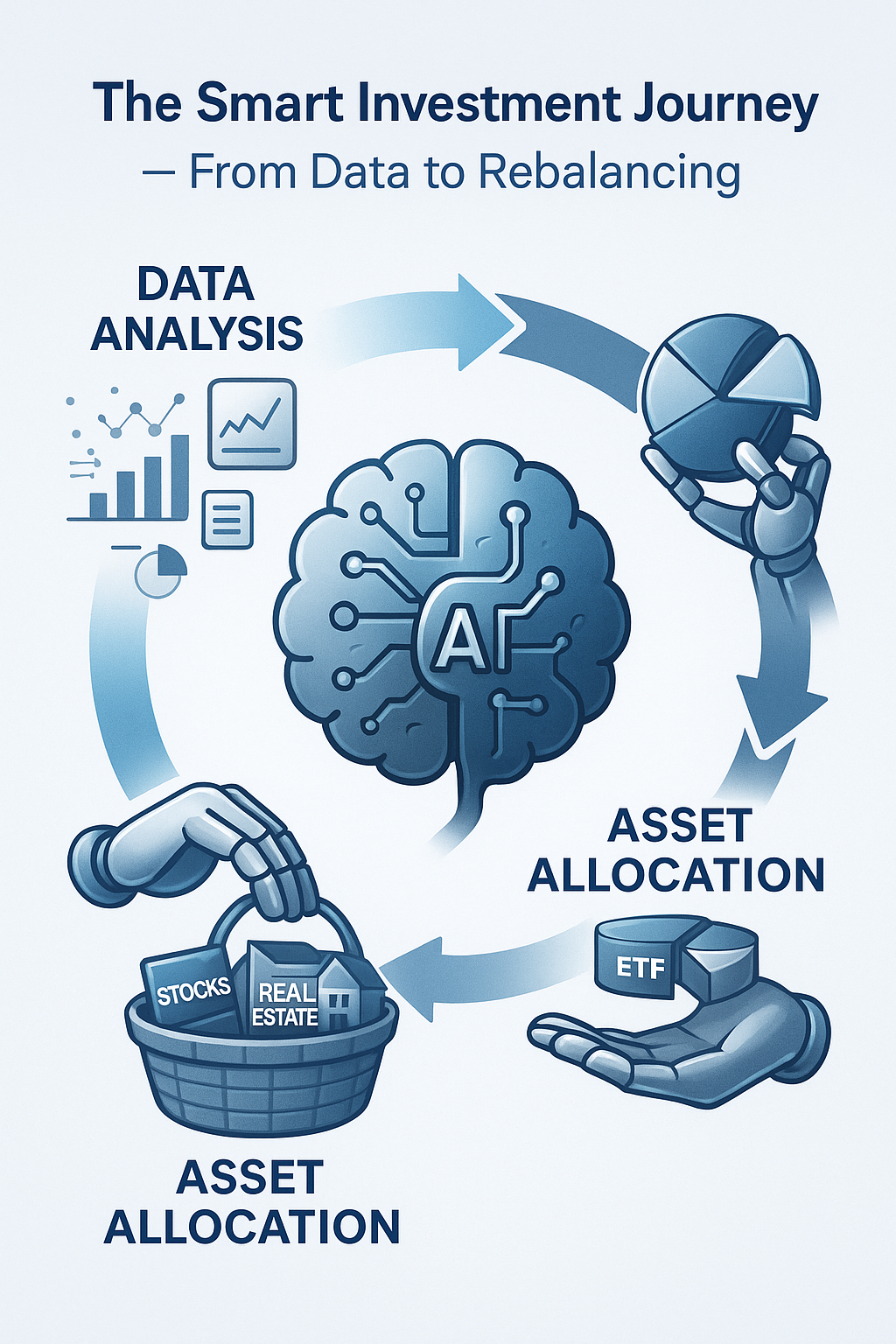

2. How AI-Based Robo-Advisors Work

AI robo-advisors use algorithms to analyze market data, assess volatility, and automatically adjust portfolio weights. The goal is to optimize returns while minimizing human bias and emotional trading.

- Data analysis: AI processes massive financial datasets in real time.

- Asset allocation: Dynamically shifts between stocks, bonds, and ETFs.

- Rebalancing: Automatically maintains your target portfolio ratio.

- Predictive modeling: Uses machine learning to forecast market behavior.

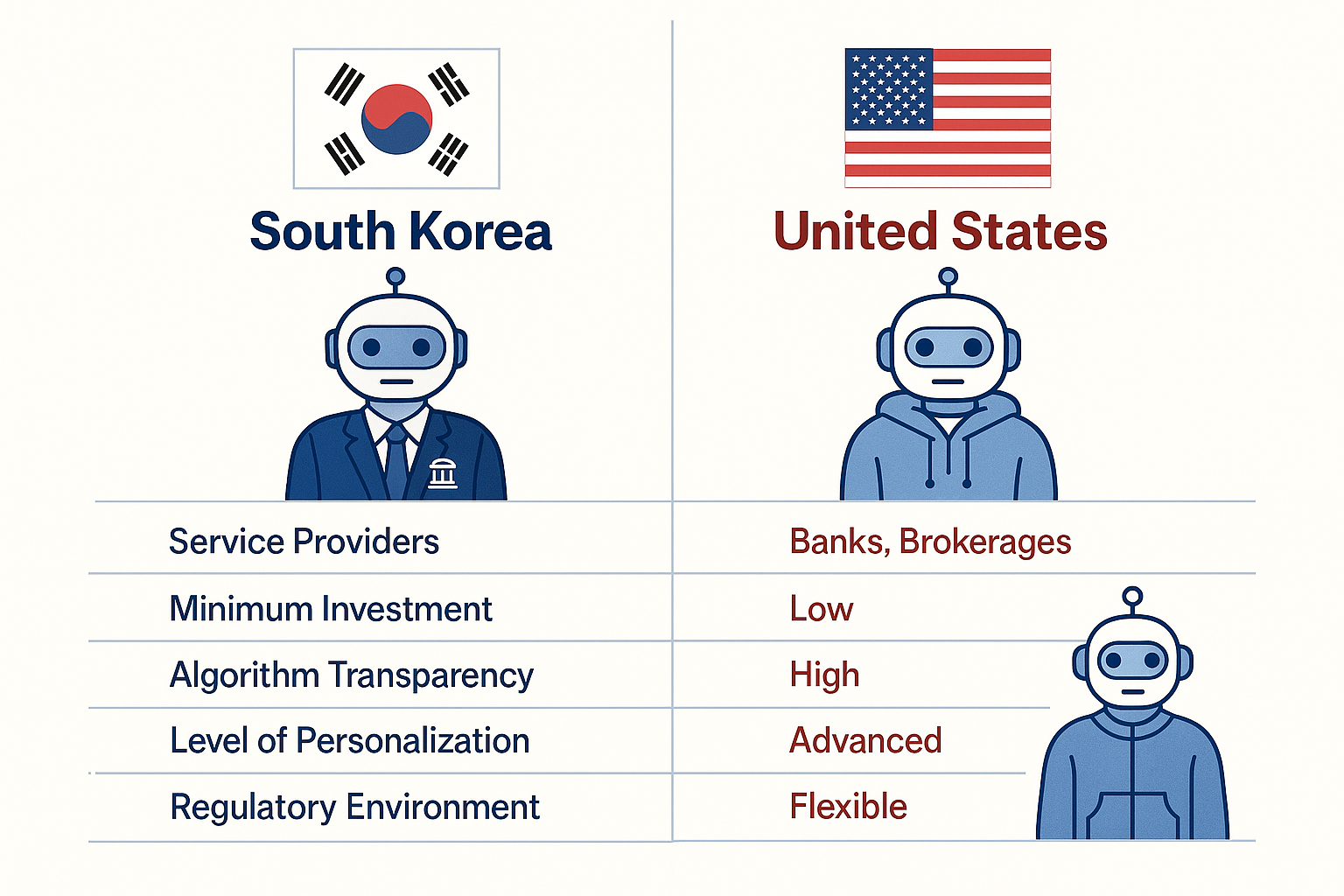

3. Key Factors to Compare Before Choosing

- Fees: Most AI robo-advisors charge 0.25%–1.2% annually, including management and ETF costs.

- Minimum investment: Ranges from ₩100,000 for Korean apps to $500–$2,000 for global platforms.

- Transparency: Choose platforms that clearly disclose how their AI models make decisions.

- Regulation: Ensure the provider is licensed (e.g., Korea’s FSS or U.S. SEC).

- Currency & tax impact: Overseas investors should review FX conversion and local tax laws.

4. Best Use Cases for AI Robo-Advisors

- Long-term, hands-free investing for busy professionals.

- Beginner investors who prefer passive strategies.

- Data-driven traders seeking hybrid AI + manual approaches.

- Wealth builders using auto-deposit for consistent growth.

5. Pro Tips for Maximizing ROI

- Don’t rely entirely on AI forecasts — combine human judgment when needed.

- Compare 2–3 platforms and monitor quarterly performance.

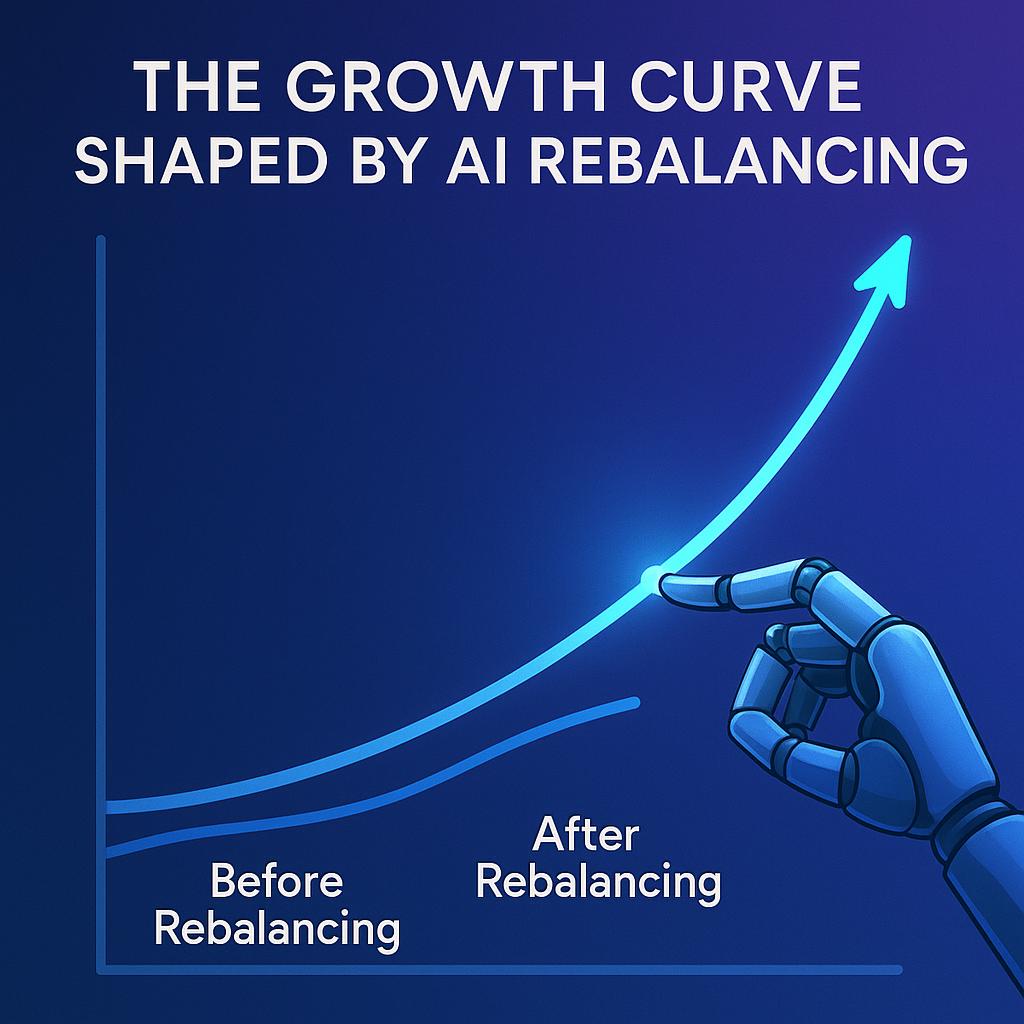

- Enable automatic rebalancing and reinvest dividends.

- Review your risk profile annually as markets evolve.

Conclusion — Smarter Investing Through Automation

AI-based robo-advisors are reshaping personal finance in 2025. Platforms like Fount, MoFin, and Betterment make it possible to invest intelligently without needing constant market monitoring. The key is aligning each platform’s strengths with your goals, time horizon, and risk tolerance. With consistent contributions and AI-driven optimization, financial growth can truly become automatic.

Sources

- Financial Supervisory Service (Korea, 2025)

- Betterment Official Blog (2025)

- Seoulz Tech Review (2025)

- Fidelity Investments Research (2025)

Disclaimer: This content is for educational purposes and not financial advice. Investing involves risk, including possible loss of principal. Always verify fees, regulation, taxation, and suitability for your situation before investing.

SEO Tags (copy into WordPress tags section):

ai robo-advisor, ai investing, stock automation 2025, betterment review, fount korea robo-advisor, automated investing tools, passive income investing, ai stock trading, robo investing platforms, schwab intelligent portfolios, fidelity go review