Insurance Comparison & Premium Guides — How to Choose the Right Policy in 2025

Choosing the right insurance policy can be confusing with so many providers, coverage options, and premium rates. Whether you’re buying health, auto, or home insurance, knowing how to compare plans wisely can help you save money while maintaining strong protection. This guide will walk you through the essentials of insurance comparison and premium evaluation in 2025.

1. Understanding the Basics of Insurance Comparison

Insurance comparison means reviewing different policies to find one that best matches your needs, lifestyle, and budget. The key is to balance coverage, premium cost, deductibles, and benefits.

Coverage Types

Every insurance type—auto, health, life, or property—offers different coverage scopes.

-

Health insurance covers medical expenses, hospitalization, and preventive care.

-

Auto insurance includes liability, collision, and comprehensive coverage.

-

Home insurance protects against fire, theft, and natural disasters.

Understanding what’s included and excluded helps avoid unexpected expenses later.

Policy Term and Renewal Options

Short-term policies give flexibility but often have higher long-term costs. Long-term plans lock in consistent rates and provide stability. Always check renewal conditions since premiums can increase after the initial term.

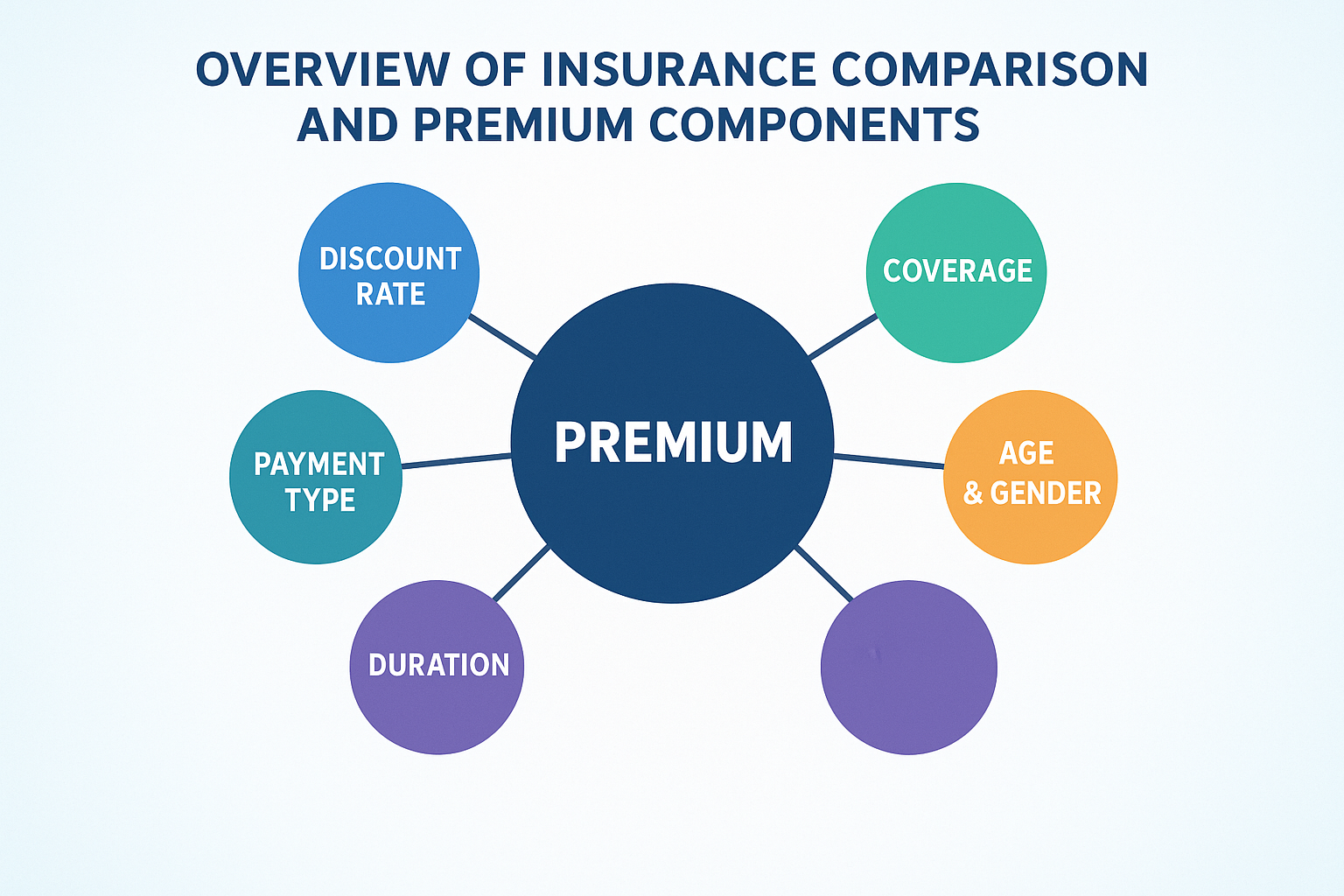

2. How to Compare Insurance Premiums

Premiums are influenced by many factors such as age, health, driving record, or even postal code. Comparing quotes from multiple providers helps identify fair pricing.

Factors That Affect Premiums

-

Age and Risk Profile – Younger drivers or healthier individuals often pay less.

-

Location – Urban areas may have higher premiums due to greater risk exposure.

-

Coverage Level – The broader your coverage, the higher the cost.

-

Deductibles – Choosing a higher deductible can lower your monthly premium.

-

Claim History – A clean record helps secure better rates.

Using Comparison Tools

Online comparison websites can instantly display quotes from different insurers. When using these tools, ensure you input consistent details—coverage limits, deductible amount, and personal information—to get accurate comparisons.

3. Tips for Saving on Insurance Premiums

-

Bundle Policies — Many insurers offer discounts when you combine home and auto policies.

-

Improve Your Credit Score — Insurers often use credit ratings to determine premium levels.

-

Increase Your Deductible — Paying a bit more upfront during claims can lower your ongoing premium.

-

Review Annually — Reassess your coverage each year as your life circumstances change.

-

Ask for Discounts — Check for loyalty or safety discounts (e.g., installing security systems or completing safe driving courses).

4. Evaluating the Right Policy for You

When comparing policies, don’t just focus on price. Consider:

-

Reputation and claim settlement ratio of the insurance company

-

Customer service quality and responsiveness

-

Policy exclusions and fine print

-

Financial stability of the provider

A slightly higher premium might be worth it if the insurer has a strong record of paying claims quickly and offering better support.

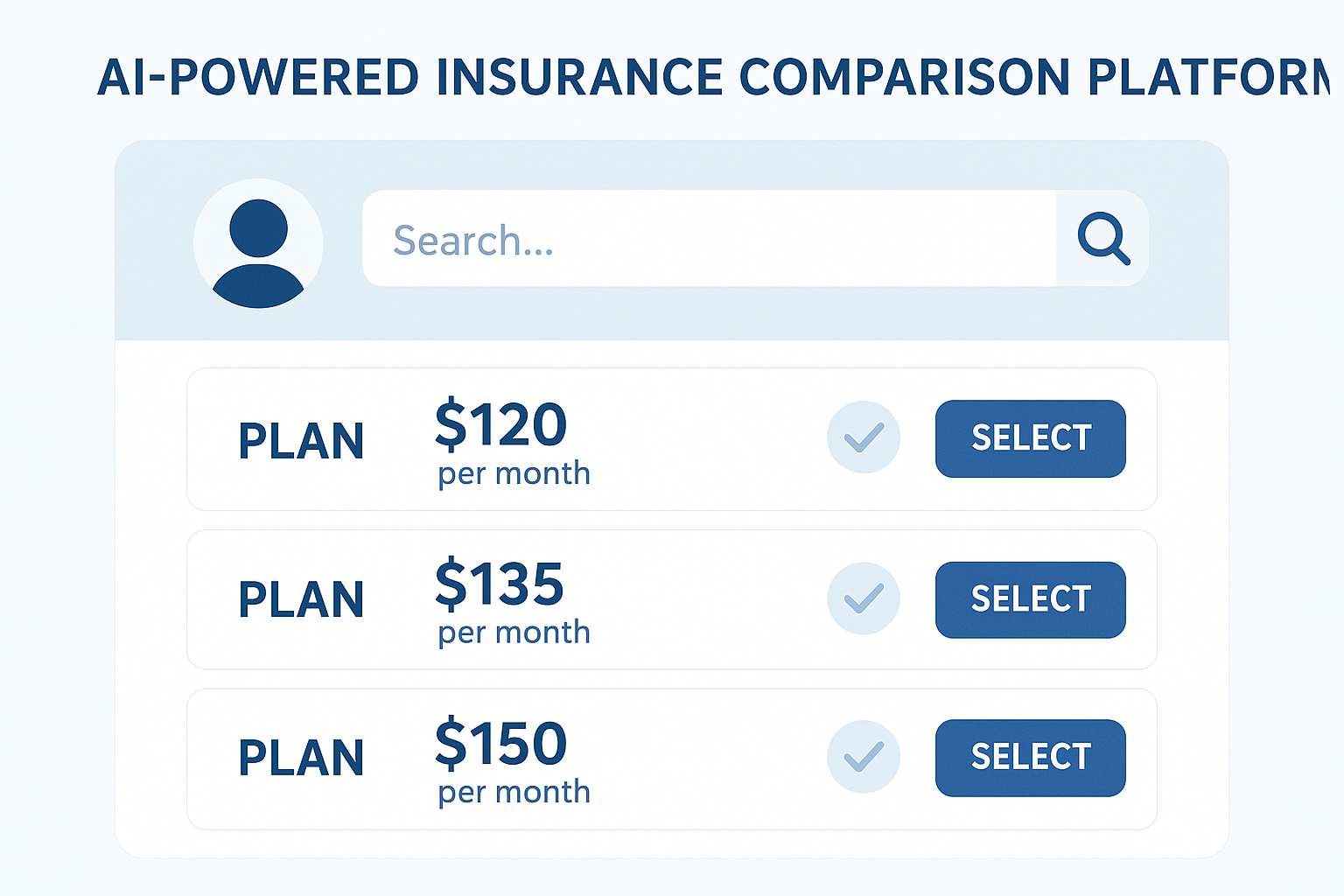

5. The Future of Insurance Comparison in 2025

Technology is making insurance comparison smarter and faster. Artificial intelligence (AI) and big data allow insurers to personalize quotes more accurately. Expect to see:

-

AI-powered comparison platforms that predict the best policy for your lifestyle

-

Usage-based premiums in auto insurance that adjust based on driving behavior

-

Digital health data integration for customized health insurance pricing

Conclusion — Making Smart Insurance Decisions

Comparing insurance policies isn’t just about finding the cheapest premium; it’s about getting the right balance of protection and affordability. By understanding how premiums are calculated, using reliable comparison tools, and reviewing your policy annually, you can secure financial peace of mind while maximizing value.

Sources:

-

National Association of Insurance Commissioners (NAIC, 2025)

-

Insurance Information Institute (2025)

-

Forbes Financial Planning Report (2025)