Where to Put Your Savings in 2025 After Global Rate Hikes?

The world’s financial landscape in 2025 is changing rapidly. Following years of aggressive interest rate hikes to fight inflation, many major central banks are now signaling a possible pivot toward stabilization or gradual cuts. This shift has left depositors wondering: where should I put my savings and deposits to get the best return with safety? This comprehensive guide analyzes the latest data, market conditions, and deposit strategies ideal for 2025.

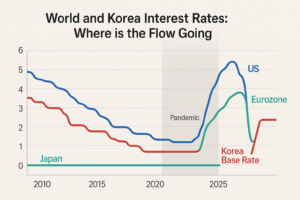

Global Monetary Trends in 2025

According to official forecasts from major financial institutions, the global rate cycle is at a turning point. The U.S. Federal Reserve, the European Central Bank, and the Bank of England are all expected to hold or slightly reduce their benchmark rates through 2025. The Federal Reserve’s rate path suggests a total of 75 basis points in cuts throughout 2025, reflecting slower growth momentum. (Bloomberg, Oct 2025)

Meanwhile, in Asia, countries like South Korea and Japan have moved cautiously. The Bank of Korea (BOK) lowered its policy rate from 2.75% to 2.50% in May 2025, citing stable inflation and weaker domestic demand. (Bank of Korea Report, May 2025)

Deposit Rate Trends in South Korea

Data from the Bank of Korea shows that the average new deposit interest rate in May 2025 was 2.63%, down from 2.71% a month earlier. By July, that number slipped to 2.51%, indicating a gradual downward trend. (Asian Banking & Finance, July 2025)

Large banks like KB Kookmin and Shinhan have also reduced long-term term deposit rates. For instance, 24-month deposits fell from about 2.4% to 2.2%. The movement indicates a broader shift toward a lower-yield environment that is likely to continue if the BOK pursues more easing.

Smart Deposit Strategies for 2025

In a world where deposit rates are falling, the key is balancing flexibility and yield. The following strategies help you stay ahead:

1. Laddered Term Deposits

Split your savings across different maturities — 6 months, 12 months, and 24 months. This ladder approach ensures part of your money matures frequently, letting you reinvest at potentially better rates if the market shifts.

2. Combine Fixed and Flexible Deposits

Lock a portion of your savings in long-term deposits (to secure current rates) while keeping some in flexible or step-up accounts. These accounts allow partial withdrawals and are perfect for maintaining liquidity.

3. Explore High-Yield and Promotional Offers

Many banks in 2025 are running promotional deposit campaigns with short-term high rates (3–4%). Always verify the minimum balance and duration before committing funds.

4. Use Digital Banks Wisely

Neo-banks or online-only banks often offer better yields due to lower overhead costs. However, always check deposit insurance coverage under the Korea Deposit Insurance Corporation (KDIC) for up to 50 million KRW protection.

International Savings Alternatives

For globally diversified investors, some foreign banks or money market funds may provide higher yields in USD or SGD deposits. However, consider currency exchange risk — the KRW/USD rate has fluctuated between 1,330–1,380 in 2025, which can impact your net return.

What to Avoid in 2025

- Over-concentration in long-term deposits as rates could rebound in 2026.

- Ignoring real inflation-adjusted returns. A nominal 2.5% return may lose value if inflation stays above 3%.

- Choosing uninsured or unregulated savings platforms promising unrealistic yields.

Best Allocation Strategy for Korean Depositors

Based on official forecasts and 2025 economic data, here’s an optimal allocation model:

- 40% – Short-term deposits (6–12 months)

- 40% – Laddered term deposits (12–36 months)

- 20% – High-liquidity or promotional accounts

Final Thoughts

The 2025 financial environment favors stability and diversification. Rates are slowly declining, but inflation remains moderate. Savers should prioritize a combination of liquidity, safety, and yield optimization. The ladder strategy, balanced deposit mix, and cautious diversification abroad are practical moves for the coming year.