Credit Score Improvement Strategies — How to Build and Maintain Strong Credit in 2025

Your credit score is more than just a number—it’s the key that unlocks better financial opportunities. Whether you’re applying for a mortgage, a business loan, or a premium credit card, your credit rating directly influences interest rates, approval odds, and even job applications in some industries. This guide explains how credit scores work, how to raise them effectively, and how to manage your credit health across different countries.

1. Understanding Credit Scores and How They Work

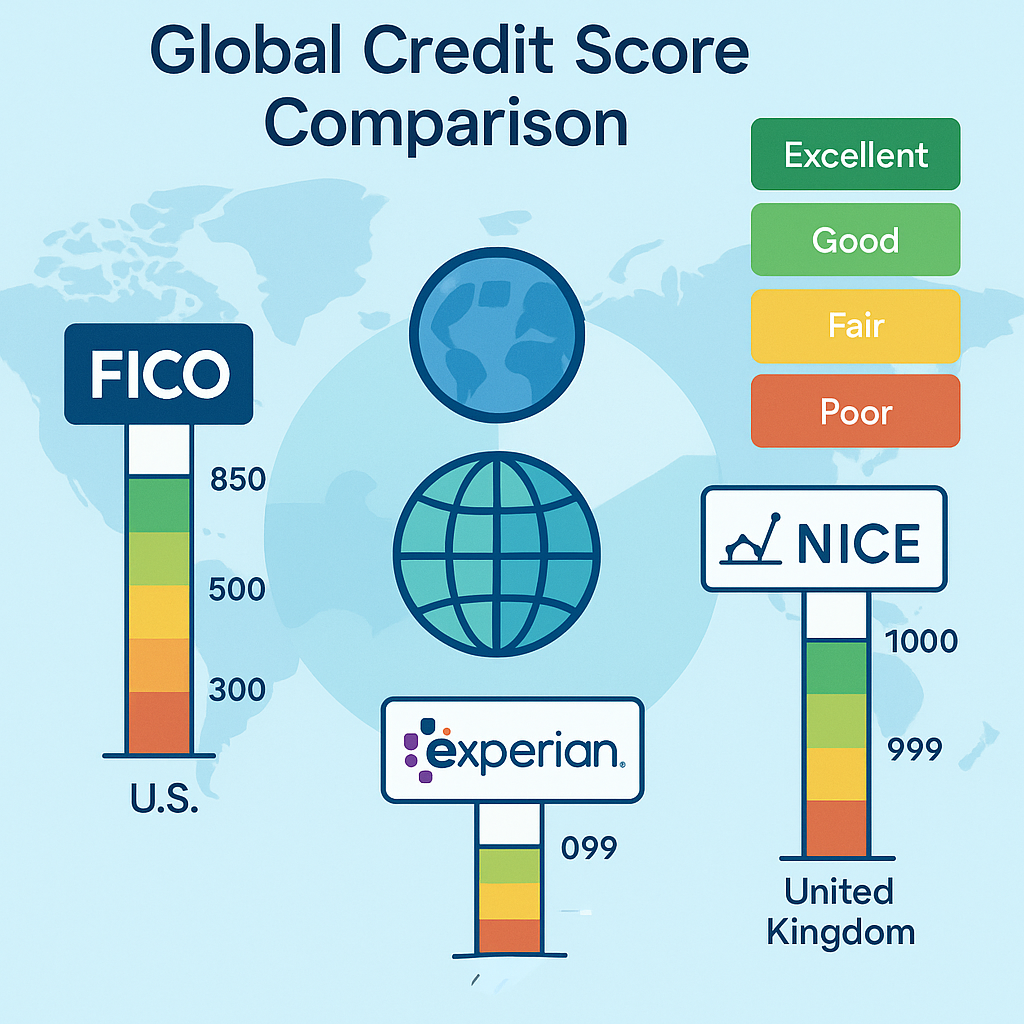

Credit scores are numerical summaries of your financial trustworthiness, typically ranging from 300 to 850. They are calculated using factors like payment history, credit utilization, account age, and inquiries. In the United States, the most common model is the FICO Score, while other countries use variations such as Korea’s KCB/NICE Score or the UK’s Experian Credit Rating.

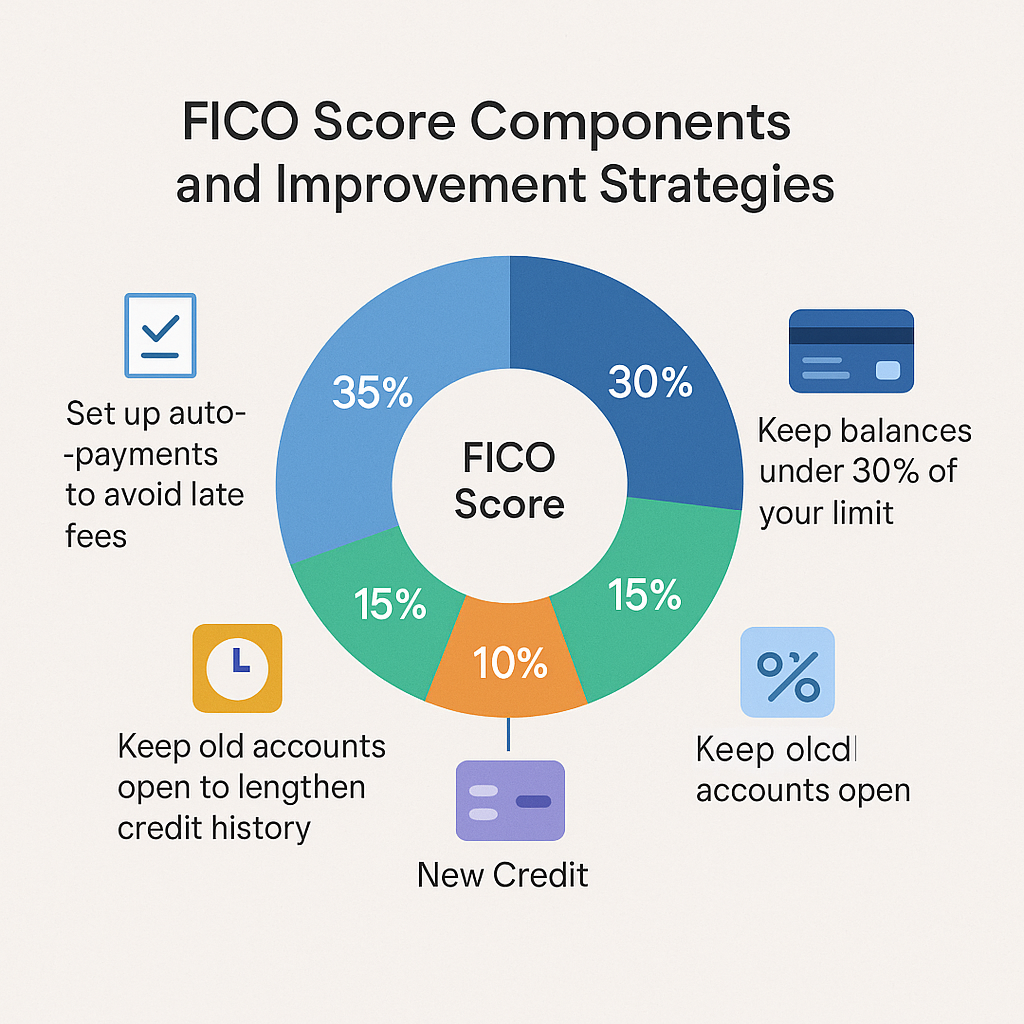

1.1. FICO Score Breakdown

- 35% – Payment History: Late or missed payments hurt the score most.

- 30% – Credit Utilization: Keep balances under 30% of your limit (under 10% is ideal).

- 15% – Credit Age: Older accounts improve average credit age.

- 10% – New Credit: Too many recent inquiries may reduce your score.

- 10% – Credit Mix: A combination of loans and credit cards is beneficial.

1.2. How Credit Scores Differ by Country

While FICO dominates in the U.S., other systems follow similar logic. In Korea, bureaus like KCB and NICE evaluate payment behavior, loan history, and delinquency records. In the U.K. and EU, Experian and Equifax assign ratings from “Poor” to “Excellent.” Maintaining on-time payments and low utilization improves your score universally, regardless of the region.

2. Proven Strategies to Improve Your Credit Score

Improving your credit score doesn’t happen overnight—but consistent, disciplined actions can raise it significantly within months. Below are effective, evidence-based tactics used by financial experts worldwide.

2.1. Pay On Time, Every Time

Payment history carries the heaviest weight in your credit score. Set up automatic payments, reminders, or use budgeting apps to ensure all bills—loans, cards, utilities—are paid before the due date. Even a single 30-day late payment can drop your score substantially.

2.2. Reduce Credit Utilization Ratio

Keep your revolving credit usage below 30%, and ideally under 10% for the best results. If your total credit limit is $10,000, aim to maintain balances below $3,000. Requesting a higher limit from your card issuer (without increasing spending) can also improve your utilization percentage.

2.3. Avoid Frequent Hard Inquiries

Each credit card or loan application triggers a “hard inquiry,” which can lower your score temporarily. Space out applications and avoid applying for multiple accounts within a short time. Soft inquiries—such as pre-approvals or checking your own credit—do not impact your score.

2.4. Keep Old Accounts Open

Closing old credit cards can reduce your average account age and available credit—both negative for your score. Keep older, no-fee cards active by making small periodic purchases and paying them off immediately.

2.5. Build Credit with Secured or Student Cards

If you’re new to credit or recovering from poor credit, start with a secured card (backed by a cash deposit). Responsible use builds positive payment history, eventually qualifying you for unsecured credit lines and loans.

2.6. Monitor Your Credit Report Regularly

Check your credit reports at least once a year. In the U.S., you can obtain free reports from AnnualCreditReport.com. Review for errors such as incorrect balances, unauthorized accounts, or outdated information—and dispute them promptly to restore lost points.

3. International Credit: Using Foreign Credit History

For expatriates, entrepreneurs, or global professionals, maintaining credit across countries can be challenging. However, some financial institutions support credit history portability or alternative data solutions.

- American Express Global Transfer: May help you establish cards in a new country based on existing AmEx history.

- Nova Credit: Enables certain U.S. lenders to assess overseas credit data (e.g., Experian UK, CRIF India) for newcomers.

- Korean Borrowers: Some lenders may consider verification services from KCB/NICE when evaluating immigrants’ histories.

4. Credit Score Myths and Misconceptions

Many people hurt their credit scores because they believe outdated or incorrect information. Let’s clarify some common myths:

- Myth: Checking your credit lowers your score.

Fact: Only hard inquiries from lenders affect it; checking your own report doesn’t. - Myth: Carrying a balance improves your score.

Fact: Paying in full every month is best; balances only add interest cost. - Myth: Closing unused cards helps.

Fact: It can lower your score by shortening history and raising utilization.

5. Long-Term Credit Health Habits

Great credit is an ongoing discipline. Keep debt manageable, review reports regularly, and avoid high-interest borrowing unless strategically justified (e.g., business expansion with clear ROI). Over time, responsible habits compound into excellent credit, unlocking better terms and opportunities.

Conclusion — Credit Confidence for the Future

Your credit score reflects financial reliability and consistency. With careful management, patience, and the right strategies, you can build a credit profile that opens doors worldwide. Whether improving your FICO score in the U.S. or maintaining excellent KCB ratings in Korea, smart credit habits are a universal advantage.

Sources:

– FICO Consumer Education Report (2025)

– KCB Credit Data Insights (2025)

– Experian Global Credit Report (2025)

– U.S. Federal Trade Commission (2025)

– OECD Financial Literacy Study (2025)