New York Directors & Officers (D&O) Insurance Cost (2025): What Firms Should Budget

Meta Description: Review D&O insurance cost in New York for 2025 — common premium drivers (company size, sector, claims history) and budgeting advice for organizations.

1️⃣ Introduction

Directors & Officers (D&O) insurance protects company executives and board members from personal liability arising from management decisions. In 2025, New York firms continue to face complex regulatory environments and litigation risks, especially in financial services, real estate, and technology. Understanding how premiums are set and how to control them helps organizations maintain both compliance and fiscal efficiency.

2️⃣ What D&O insurance covers

D&O insurance shields corporate leaders from financial loss due to lawsuits alleging wrongful acts, mismanagement, or breach of fiduciary duty. It typically includes:

- Side A: Protects individual directors/officers when the company cannot indemnify them.

- Side B: Reimburses the company when it indemnifies executives.

- Side C: Covers the company itself when it is named in securities-related claims.

Coverage often extends to defense costs, settlements, and regulatory investigations, though exclusions apply for fraud or intentional misconduct.

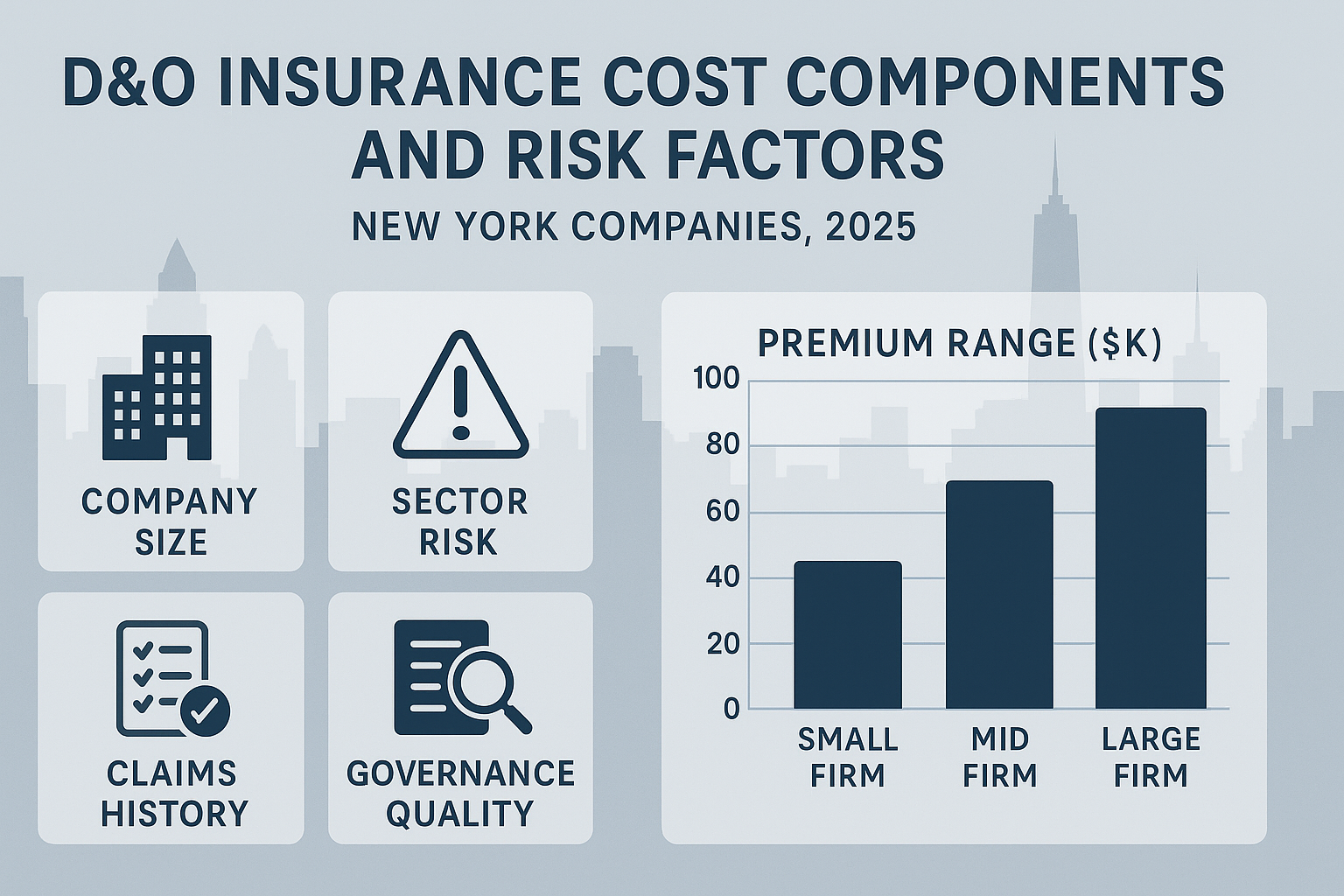

3️⃣ Key premium drivers: turnover, sector risk, past claims

Premiums for New York D&O policies in 2025 are influenced by multiple underwriting factors. The city’s high litigation activity and financial concentration drive higher-than-average rates compared to national benchmarks. Primary drivers include:

- Company size and revenue: Larger firms face broader exposure and higher policy limits.

- Industry risk profile: Finance, biotech, and tech sectors often experience higher premiums due to regulatory scrutiny.

- Claims history: Previous lawsuits or shareholder disputes significantly increase rates.

- Corporate governance strength: Transparent reporting and active compliance programs can reduce costs.

For 2025, small-to-mid-sized New York firms report average annual premiums between $8,000 and $25,000, while large or publicly traded entities may exceed $100,000 depending on coverage scope.

4️⃣ Typical limit/retention structures for US firms

D&O limits are chosen based on company scale, industry, and investor expectations. Common coverage structures include:

| Company Type | Typical Limit | Retention (Deductible) |

|---|---|---|

| Private SME | $1M–$5M | $10K–$25K |

| Mid-Market / VC-Backed | $5M–$15M | $25K–$100K |

| Public Company | $25M–$100M+ | $250K–$1M |

Excess layers may be added for higher-risk sectors, such as financial services or listed firms subject to SEC scrutiny.

5️⃣ How to reduce cost: governance, risk controls, bundling

Strong governance and clear risk management frameworks remain the most effective ways to control D&O premiums. Companies can also reduce costs by:

- Maintaining accurate financial reporting and independent audits.

- Implementing cybersecurity and compliance programs aligned with NYDFS and SEC expectations.

- Bundling D&O with Employment Practices Liability (EPLI) or Cyber coverage for multi-policy discounts.

- Engaging brokers who specialize in corporate risk and can negotiate layered programs.

6️⃣ Contractual triggers & renewal preparation

Before renewal, firms should review corporate bylaws, indemnification clauses, and investor agreements for D&O obligations. Contractual triggers — such as funding rounds, mergers, or listing changes — may require additional coverage or new underwriter approval. Renewal preparation should include updated financial statements, claims logs, and board governance reports to streamline underwriting review and avoid premium surges.

FAQs

Q1. Do small businesses need D&O cover?

A1. Yes — even private firms with boards, investors, or external directors face exposure to management-related claims.

Q2. What limit should I buy?

A2. Align limits with potential liability, investor expectations, and contract requirements; most private New York firms hold $1–$5 million in coverage.

Q3. Are personal exposures included?

A3. Yes — D&O insurance covers individual directors and officers for eligible claims, typically under Side A protection.

Conclusion

In 2025, New York companies continue to face elevated D&O insurance costs due to legal complexity and market volatility. Evaluating governance practices, maintaining clear financial disclosure, and using specialist brokers can help control premiums while preserving essential executive protection.

References

- National Association of Insurance Commissioners (NAIC)

- IRMI — Directors & Officers Insurance Overview

- Insurance Journal — US D&O Market Trends 2025