Top Digital Marketing Tools for PPC & SEO in 2025 — Maximize Your Growth

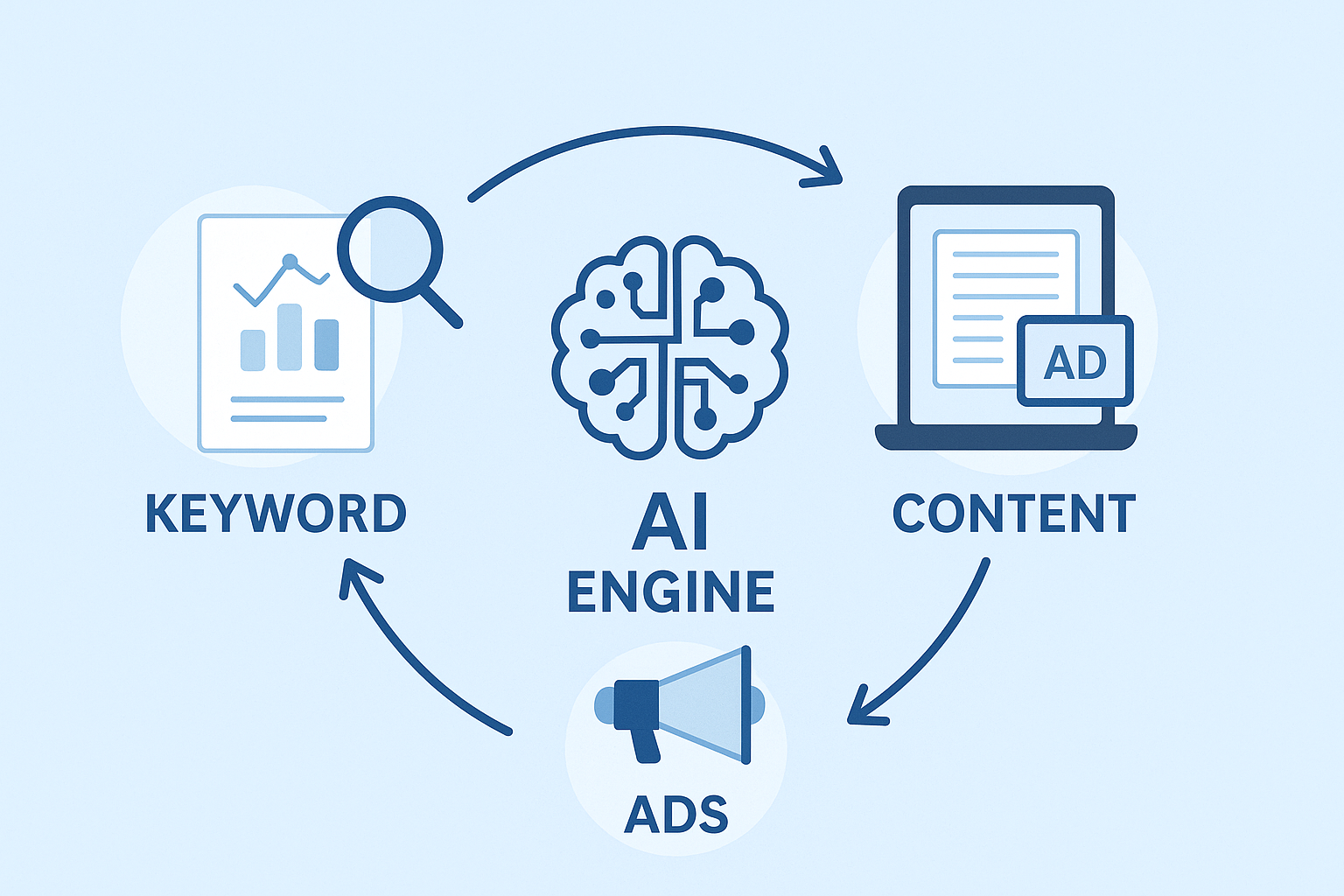

In 2025, digital marketing continues to evolve at lightning speed. From AI-driven automation to smarter analytics, marketers now have powerful tools that make it easier to optimize campaigns, target audiences, and measure performance. Whether you’re managing pay-per-click (PPC) ads or fine-tuning search engine optimization (SEO), using the right tools can dramatically increase your ROI and efficiency.

Why the Right Tools Matter in 2025

With competition growing across every digital platform, marketers can no longer rely on intuition alone. Advanced tools powered by AI, automation, and predictive analytics help you make data-driven decisions faster. They provide deeper insights into customer behavior, keyword trends, and ad performance — giving you the edge to stay ahead of competitors.

Best SEO Tools for 2025

1. Semrush

Semrush remains one of the most comprehensive SEO suites in 2025. It offers advanced keyword tracking, site audits, backlink analytics, and content optimization powered by AI. The “Keyword Intent” feature now predicts what users are likely to do next — making content targeting more accurate than ever.

2. Ahrefs

Known for its massive backlink database and accurate search volume metrics, Ahrefs continues to dominate technical SEO and competitor research. Its 2025 update includes real-time rank tracking and AI-driven content gap analysis that suggests new topic opportunities automatically.

3. Google Search Console (GSC)

Still a must-have in every SEO toolkit, GSC gives you direct insights from Google about how your site performs in search results. The new “Page Experience Insights” dashboard in 2025 integrates Core Web Vitals with UX scoring, helping site owners improve rankings through better user experience.

Top PPC Tools for 2025

1. Google Ads with Performance Max

Google Ads remains the backbone of PPC advertising. In 2025, its “Performance Max” campaigns have become even smarter, using AI to automatically find high-performing combinations of creatives, keywords, and audience segments across all Google channels.

2. Microsoft Advertising

With integrations into LinkedIn data and AI-powered automation, Microsoft Advertising is a hidden gem for marketers targeting professional audiences. The 2025 platform update offers predictive bidding strategies that adjust based on conversion likelihood in real time.

3. Meta Ads Manager (Facebook & Instagram)

Meta Ads Manager continues to lead in social PPC. Its “Advantage+” automation in 2025 uses machine learning to optimize creative placement and audience segmentation automatically, reducing cost per conversion for advertisers worldwide.

4. Optmyzr

Optmyzr is a PPC automation powerhouse. It connects directly to Google and Microsoft Ads accounts, allowing marketers to use rule-based optimization, bid management, and budget forecasting. The 2025 AI assistant even suggests campaign improvements in plain language.

Emerging AI & Automation Tools

1. Surfer SEO

Surfer SEO combines on-page optimization with AI-generated content outlines. The 2025 update integrates directly with Google Docs and WordPress, helping teams write data-optimized articles faster than ever.

2. Jasper (formerly Jarvis)

Jasper AI remains one of the top AI writing tools for marketers. It generates ad copy, blog content, and SEO-optimized descriptions in seconds — perfect for scaling content production without losing quality.

3. AdCreative.ai

For PPC teams, AdCreative.ai is a game changer. It generates ad creatives, images, and headlines automatically based on campaign goals, ensuring consistent high CTRs across platforms like Google, Meta, and TikTok.

How to Choose the Right Marketing Tools

When selecting your digital marketing toolkit, consider these factors:

- Integration: Choose tools that sync with your CRM, analytics, or CMS systems.

- Automation: Save time by using AI-driven automation for bidding, reporting, or keyword tracking.

- Scalability: Ensure the tool can handle growing data and campaign complexity.

- Support & Training: Look for platforms that offer strong documentation, webinars, or certifications.

Conclusion — The Future of Digital Marketing Tools

In 2025, successful digital marketing is no longer about guesswork — it’s about using the right tools to make smarter decisions. AI and automation are leading the way, allowing marketers to optimize faster and personalize at scale. Whether you’re managing PPC campaigns or climbing search rankings, investing in the right technology stack will be your biggest competitive advantage this year and beyond.

Stay adaptable, test new tools, and let data guide your strategy — that’s how you’ll thrive in the ever-changing digital marketing landscape of 2025.

Sources:

- Google Ads Blog (2025)

- HubSpot Marketing Trends Report (2025)

- Search Engine Journal (2025)