Best High-Interest Savings Accounts & CDs in the U.S. (2025 Guide)

In 2025, interest rates remain high across the United States, making it a great time for savers to earn more from their cash. Whether you prefer the flexibility of a savings account or the stability of a certificate of deposit (CD), choosing the right high-yield option can significantly boost your returns. This comprehensive guide breaks down the best high-interest savings accounts and CDs in the U.S. for 2025, comparing rates, features, and key considerations.

1. What to Look for in a High-Interest Account

Before selecting a savings account or CD, it’s crucial to understand what factors make one product better than another. High interest rates are important, but other details—such as fees, withdrawal limits, and customer service—can make a big difference in your overall experience.

- APY (Annual Percentage Yield): The higher the APY, the more interest you’ll earn over time.

- Minimum Balance Requirements: Some banks require a specific amount to open or maintain the account.

- Monthly Fees: The best accounts charge no maintenance or transaction fees.

- FDIC or NCUA Insurance: Always ensure your deposits are insured up to $250,000 per depositor.

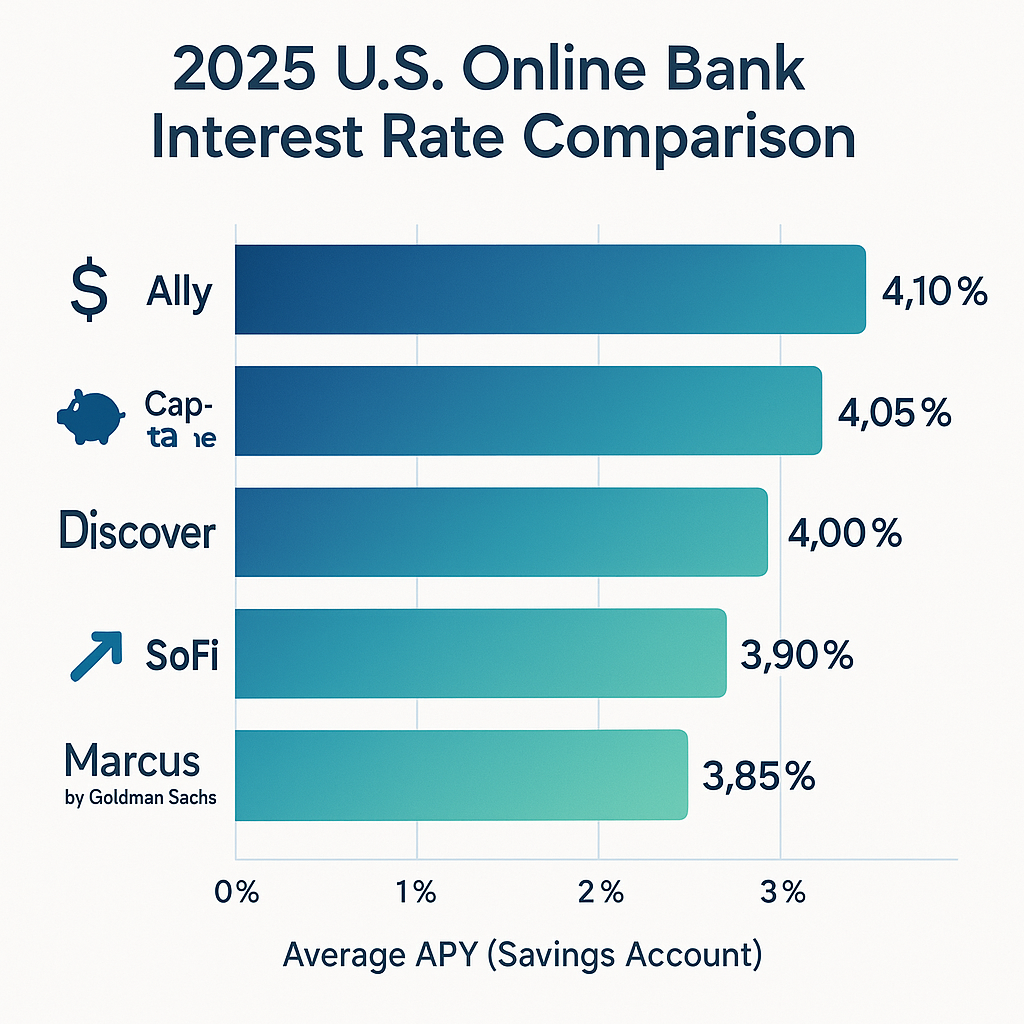

2. Best High-Interest Savings Accounts in 2025

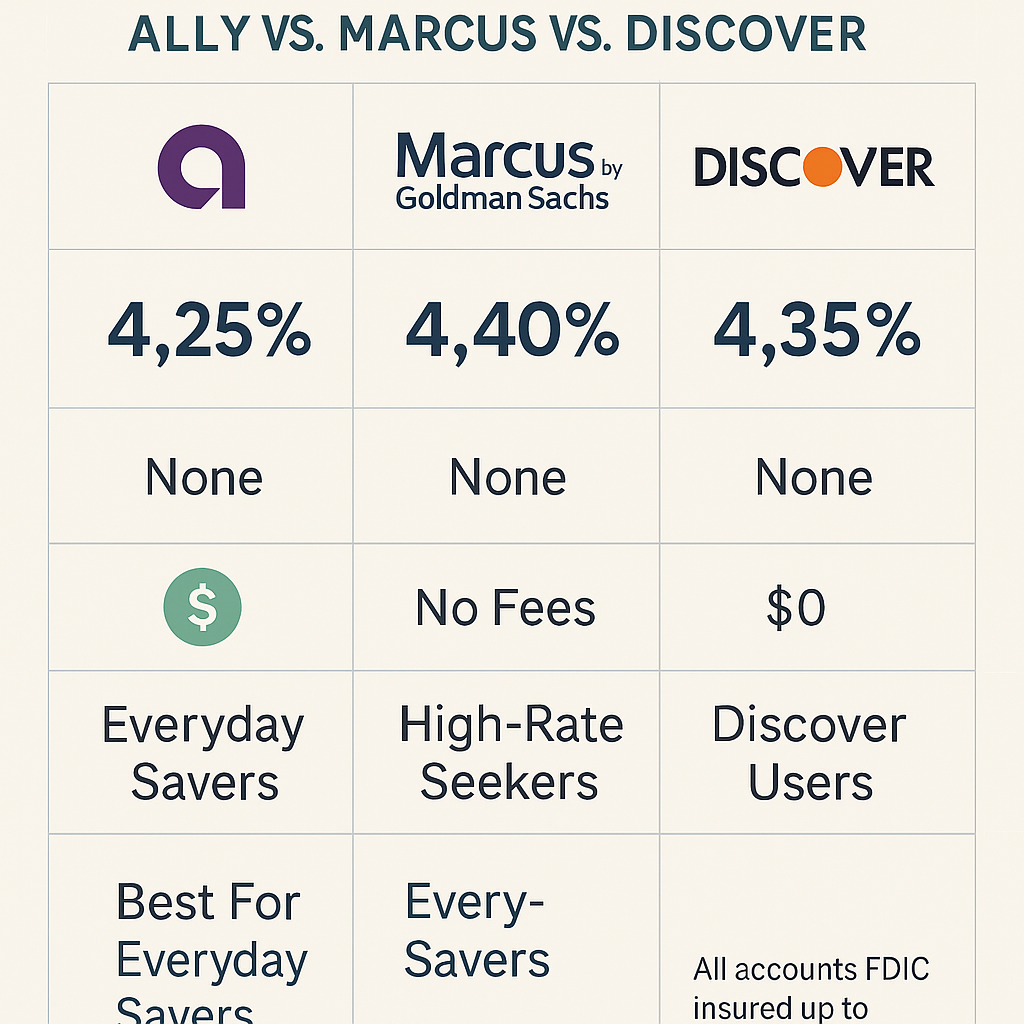

Ally Bank — 4.25% APY

Ally Bank continues to be one of the top online banks, offering a competitive 4.25% APY on its savings accounts with no minimum balance requirement. It’s a great choice for users who prefer an easy-to-use mobile app and no hidden fees.

Marcus by Goldman Sachs — 4.40% APY

Marcus offers one of the highest savings rates available, combined with a straightforward online platform. There are no fees and no minimum deposits, making it ideal for both beginners and experienced savers.

Discover Bank — 4.35% APY

Discover’s online savings account provides strong rates and excellent customer support. It’s a solid option for those who already use Discover credit cards or other financial products.

3. Best CD Rates in the U.S. for 2025

Certificates of Deposit (CDs) are a safe way to lock in a fixed rate for a set period. In 2025, CD yields have surged to some of their highest levels in years. Here are the best options to consider:

Capital One — 5.10% APY (12-Month CD)

Capital One’s 12-month CD offers a 5.10% APY with no minimum deposit. The bank’s flexibility and strong online presence make it ideal for short-term investors.

Barclays — 5.00% APY (18-Month CD)

Barclays offers a slightly longer term with a similar yield. There are no minimum balance requirements, and you can manage everything online.

Synchrony Bank — 5.25% APY (24-Month CD)

Synchrony Bank leads for mid-term CDs, combining high interest rates with optional no-penalty withdrawals for certain accounts.

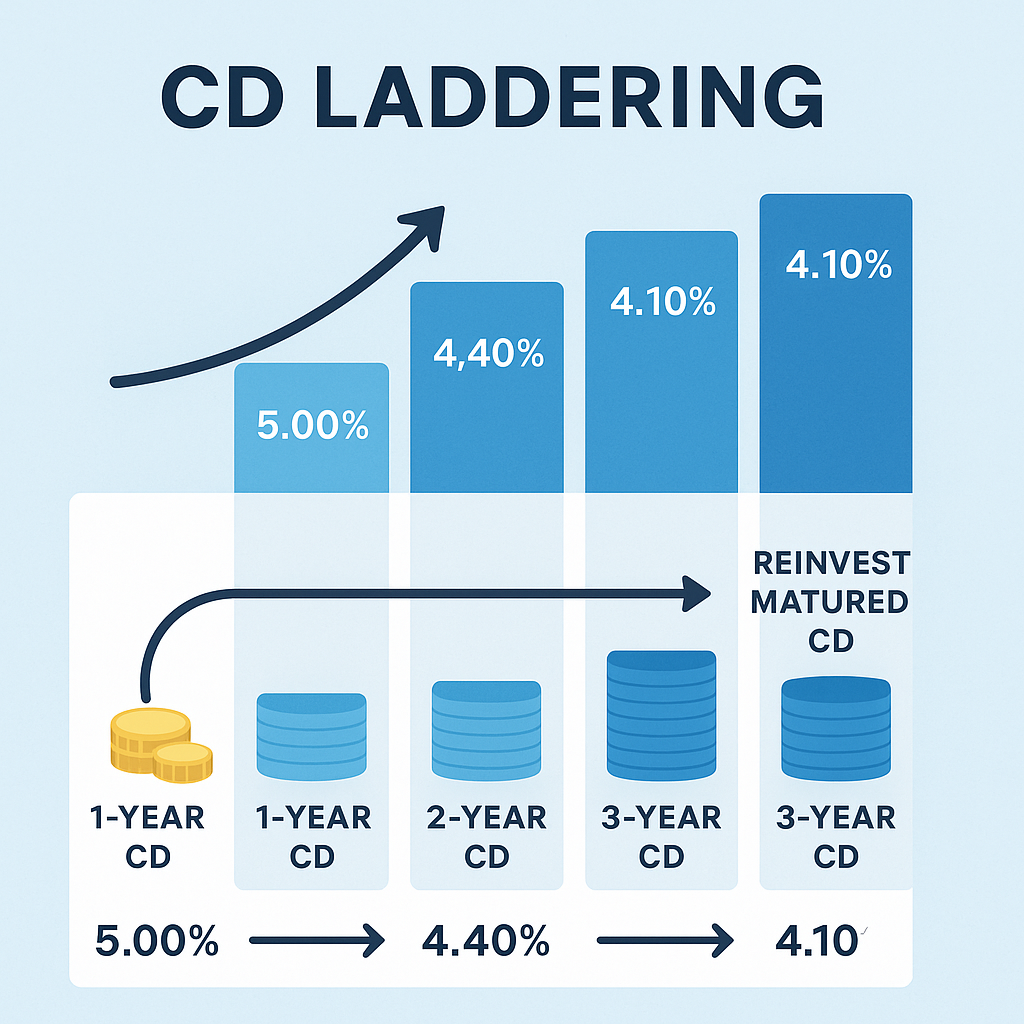

- Tip: Consider a CD laddering strategy—opening multiple CDs with staggered maturities—to balance liquidity and yield.

4. Savings Account vs. CD: Which Should You Choose?

If flexibility is your top priority, a savings account is best. You can access your money anytime without penalties. However, if you don’t need immediate access to your funds and want to lock in a higher rate, CDs offer better returns and stability.

- Choose a Savings Account if you plan to make deposits or withdrawals regularly.

- Choose a CD if you can commit your funds for a fixed period to earn higher guaranteed interest.

5. How to Maximize Your Savings in 2025

To make the most of the current high-rate environment, consider diversifying your deposits. Use multiple accounts—one for emergency funds and another for long-term savings. Automating your deposits each month ensures consistent growth, while monitoring rate updates can help you switch banks if a better offer appears.

Conclusion — Smart Saving in a High-Rate Era

With interest rates remaining elevated, 2025 offers one of the best opportunities in recent years for savers to earn more from their cash. Whether you prefer the flexibility of high-yield savings accounts or the predictability of CDs, choosing a trusted, FDIC-insured institution will help you grow your savings securely and efficiently.

Sources:

– Federal Deposit Insurance Corporation (FDIC, 2025)

– Bankrate.com (2025 High-Yield Savings Survey)

– Forbes Advisor (2025 CD Rate Report)