Business Loan Strategies — How to Secure and Optimize Funding for Your Company

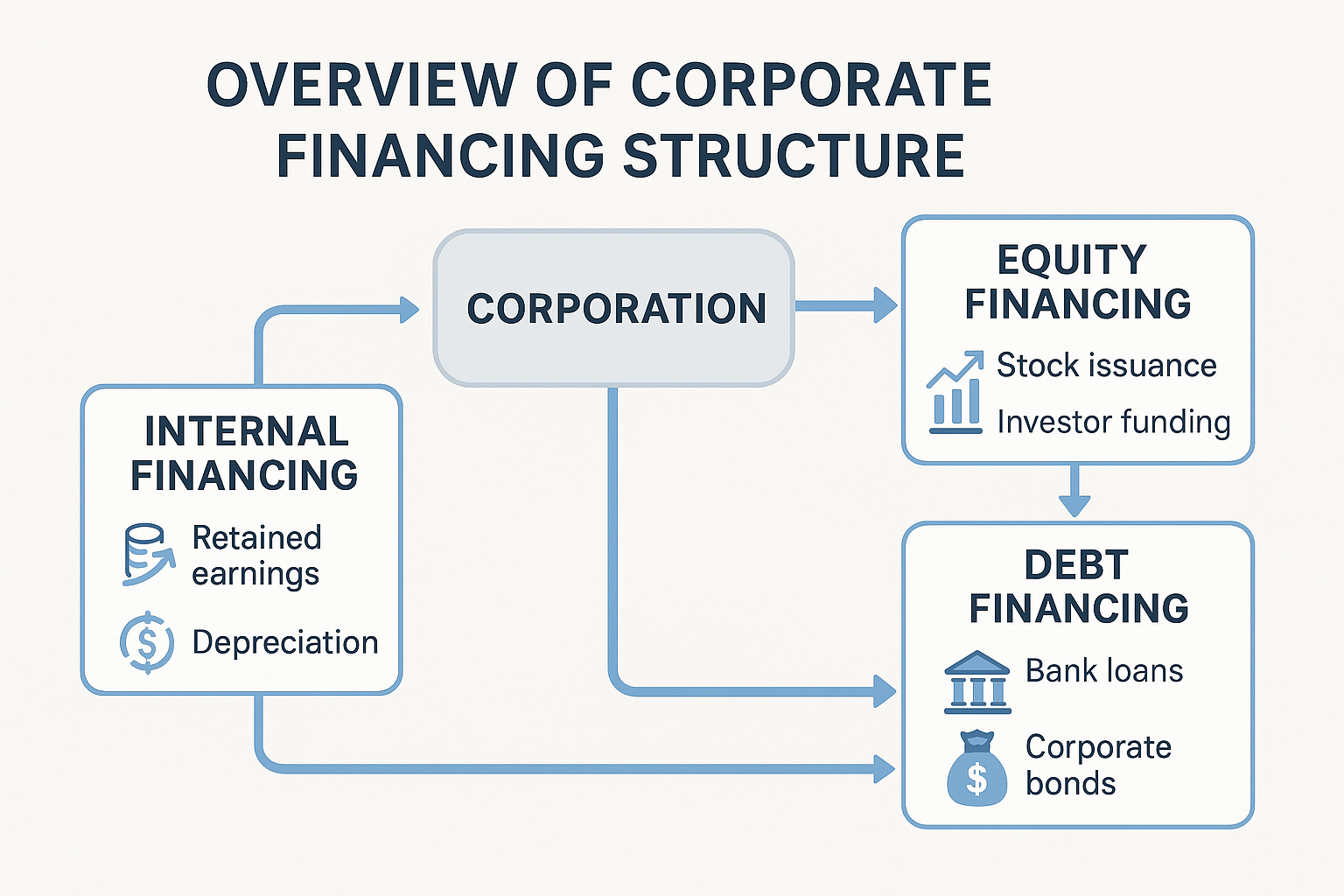

In today’s competitive business environment, access to reliable funding can define whether a company thrives or struggles. From small business loans to venture capital and corporate credit lines, understanding the landscape of business financing is essential for long-term growth. This guide explores the most effective business loan strategies, how to compare financing options, and practical steps to optimize your capital structure for success.

1. Understanding Business Loans and Funding Options

Business loans come in various forms, each designed to meet different corporate needs. Whether you’re launching a startup, scaling operations, or bridging short-term cash flow gaps, knowing which loan type suits your situation is crucial for financial stability and growth.

1.1. Traditional Bank Loans

Traditional bank loans remain the most common source of business financing. They typically offer fixed interest rates, predictable repayment terms, and the credibility of working with established financial institutions. However, approval can be slow, and lenders often demand substantial documentation and collateral. To improve approval chances, businesses should maintain clean accounting records, demonstrate consistent revenue, and establish a solid relationship with their primary bank.

1.2. Government and SBA-Backed Loans

Many governments provide specialized loan programs to support entrepreneurs, SMEs, and innovative startups. These programs often guarantee a percentage of the loan to the lender, reducing their risk and making it easier for businesses to qualify. For instance, the U.S. SBA 7(a) loan and Korea’s SEMAS funds are popular options. Such loans generally feature lower interest rates, extended repayment periods, and more lenient collateral requirements—making them a top choice for early or mid-stage businesses.

1.3. Alternative Financing — Fintech and P2P Platforms

Fintech-driven solutions have transformed the lending industry. P2P lending, invoice factoring, crowdfunding, and merchant cash advances enable faster funding access with minimal paperwork. These digital platforms use algorithms to evaluate creditworthiness, allowing even small businesses with limited credit history to secure funding. While convenient, borrowers should carefully assess interest rates, repayment terms, and platform credibility before committing.

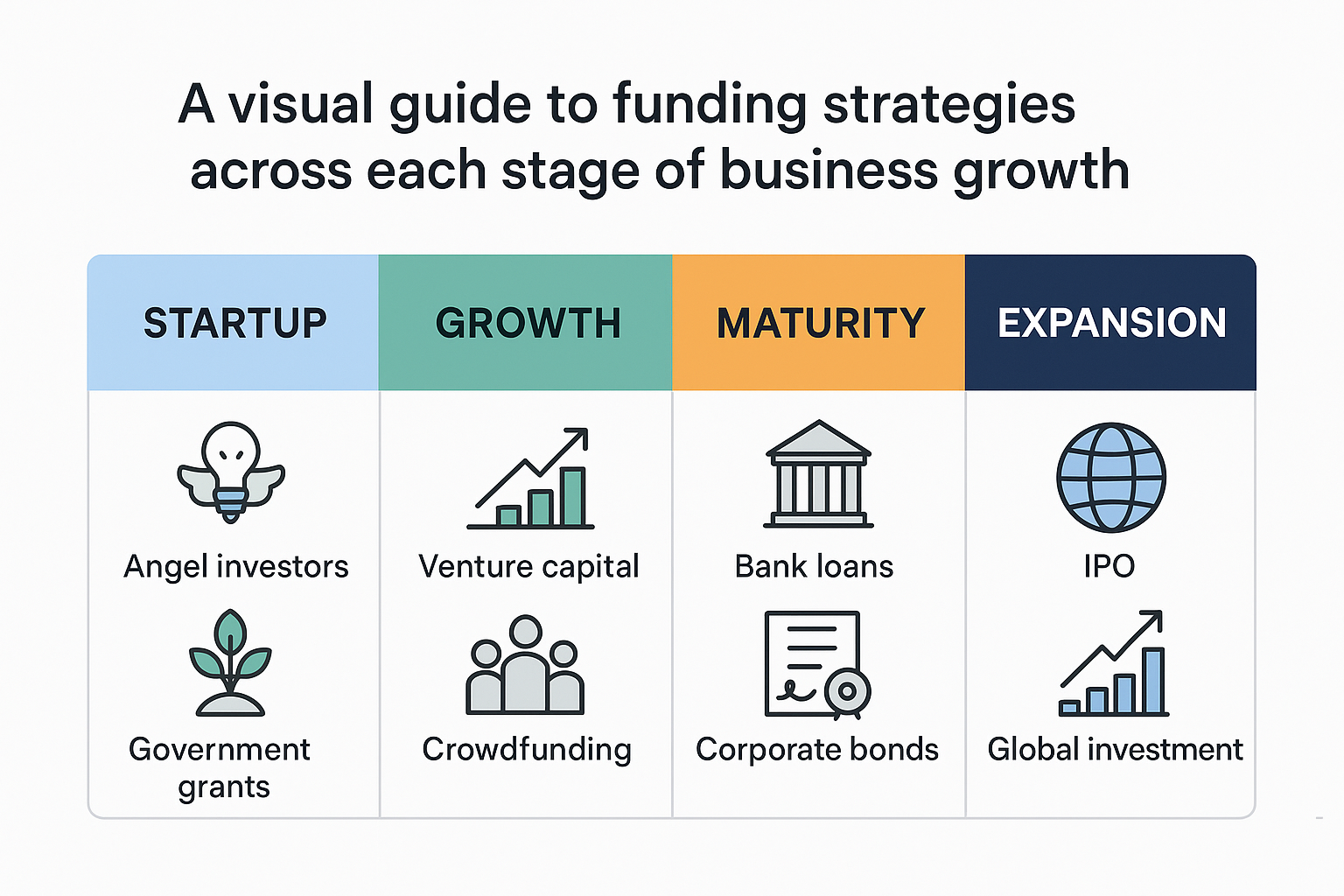

2. Comparing Funding Options for Different Business Stages

Every business passes through distinct growth phases—from startup to expansion to maturity. Each stage requires tailored financing strategies to ensure optimal capital management and sustainable growth. Choosing the right funding type for your current stage can help prevent over-leveraging and improve cash flow stability.

2.1. Startup Phase: Seed Funding and Angel Investors

During the early stage, entrepreneurs often lack sufficient collateral or credit history for bank loans. Therefore, equity-based funding becomes a practical option. Angel investors and incubator programs provide not only capital but also mentorship and networking opportunities. However, giving up equity means sacrificing partial ownership, so founders must weigh the trade-offs carefully.

2.2. Growth Stage: Venture Capital and Business Credit Lines

As a business enters its growth phase, larger funding sources become necessary. Venture capital (VC) firms invest in promising companies with high growth potential, usually in exchange for equity stakes. Meanwhile, revolving business credit lines offer flexibility—businesses can draw funds as needed and pay interest only on the used portion. This helps manage seasonal fluctuations and expansion costs without committing to large lump-sum loans.

2.3. Maturity Phase: Corporate Bonds, Private Equity, and M&A Financing

At the mature stage, companies often look for ways to optimize their capital structure and finance large-scale projects. Issuing corporate bonds can attract institutional investors and diversify funding sources. Alternatively, private equity firms can infuse significant capital for expansion, acquisitions, or restructuring. For mergers and acquisitions, a mix of debt and equity financing is common to maintain balance sheet flexibility and shareholder value.

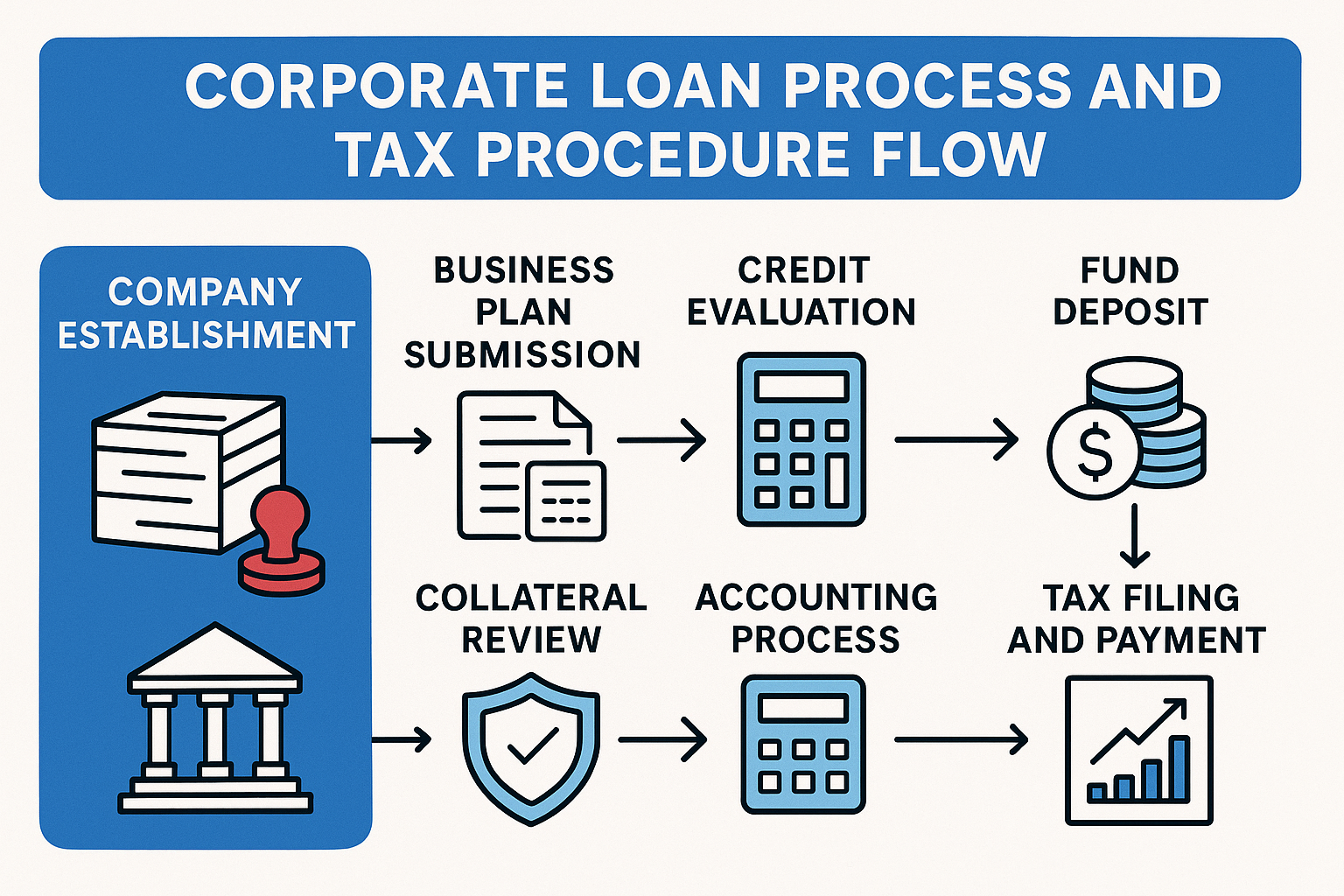

3. How to Improve Loan Approval Chances

Securing business financing requires more than just submitting an application—it involves demonstrating credibility, financial responsibility, and growth potential. Below are key strategies to increase your chances of approval:

- 1. Strengthen your credit profile: Pay existing debts on time, limit credit utilization, and correct any credit report errors.

- 2. Prepare comprehensive documentation: Include balance sheets, income statements, tax filings, and cash flow projections.

- 3. Develop a detailed business plan: Clearly outline market opportunities, competitive advantages, and how the funds will be used.

- 4. Offer collateral or guarantees: Assets such as property, inventory, or receivables can increase lender confidence.

- 5. Build relationships with lenders: Regular communication and transparency can lead to better loan terms in the future.

Some lenders also value social proof—such as positive client reviews, business awards, or strong online presence—when assessing credibility. This means investing in your company’s reputation can indirectly influence financial opportunities.

4. Financial Planning and Risk Management

Before applying for any loan, it’s crucial to evaluate your business’s ability to repay and assess the long-term impact of debt. Excessive borrowing can restrict cash flow, reduce profitability, and limit agility. A sustainable financing plan should balance debt with operational revenue and future growth forecasts.

Risk management tools such as financial forecasting, stress testing, and liquidity ratios help ensure that debt remains within manageable levels. Consulting with financial advisors or corporate finance experts can also provide insights into restructuring existing loans or consolidating high-interest debts into lower-rate instruments.

5. Tax and Legal Considerations for Business Loans

One often-overlooked benefit of business loans is tax deductibility. In most jurisdictions, interest expenses are deductible, reducing overall tax liability. However, misuse of funds or poor documentation can invalidate these benefits, so keeping detailed records is essential.

Legally, businesses must review loan agreements thoroughly. Pay attention to terms such as prepayment penalties, variable interest rates, and personal guarantees. Engaging a legal advisor can prevent future disputes or financial strain caused by unfavorable clauses.

6. The Role of Digital Transformation in Business Financing

Digitalization is reshaping how companies access funding. Fintech ecosystems now offer automated credit scoring, blockchain-based smart contracts, and instant fund disbursement. Cloud accounting tools enable real-time financial reporting, improving transparency and making loan applications faster and more accurate. Businesses that embrace these technologies often gain faster approvals and better loan terms due to improved data reliability.

Moreover, open banking initiatives allow lenders to analyze transaction data securely, leading to more personalized and risk-adjusted financing offers. This shift toward data-driven lending is expected to dominate the next decade of business financing.

Conclusion — Building a Sustainable Funding Strategy

Business financing is not just about obtaining funds—it’s about crafting a long-term strategy that supports growth, resilience, and innovation. Companies should view loans and investments as strategic tools that align with corporate goals rather than short-term cash solutions.

By diversifying funding sources, maintaining financial discipline, and leveraging both traditional and digital channels, businesses can build a stable financial foundation capable of weathering market volatility and seizing new opportunities. Whether you’re a small startup or a multinational enterprise, smart funding decisions today will shape your success for years to come.

Sources:

– U.S. Small Business Administration (2025 Report)

– OECD SME Financing Outlook (2025)

– Bank of Korea — Business Finance Trends (2025)

– World Bank — Digital Finance Report (2025)

– Google Cloud Financial Services Blog (2025)