2025 Confirmed Policy & Market Updates — Investments, Crypto, ETFs, and Funds (South Korea)

1. Crypto Regulation and Institutional Recognition

1.1. Crypto Firms Granted Venture Company Status (Effective September 16, 2025)

The Ministry of SMEs and Startups (MSS) officially announced that starting September 16, 2025, crypto-related businesses — including exchanges, brokerage firms, and wallet providers — can qualify for venture company certification under the Special Measures for Venture Business Act.

This confirmed change removes previous restrictions that excluded virtual-asset companies from venture status. Eligible firms can now access:

-

Tax benefits for certified venture businesses

-

Government-backed loans and guarantees

-

Innovation funding programs

📘 Sources: CoinTelegraph (Sept 2025); CoinCentral (Sept 2025).

1.2. Temporary Suspension of Crypto-Lending Services

The Financial Services Commission (FSC) in August 2025 ordered domestic exchanges to pause all crypto-lending products until a full legal framework is established.

This official action followed liquidity issues among over-leveraged lending platforms.

The freeze applies to new crypto loans, interest-earning accounts, and staking-like lending products.

📘 Sources: The Block (Aug 2025); JD Supra (Aug 2025).

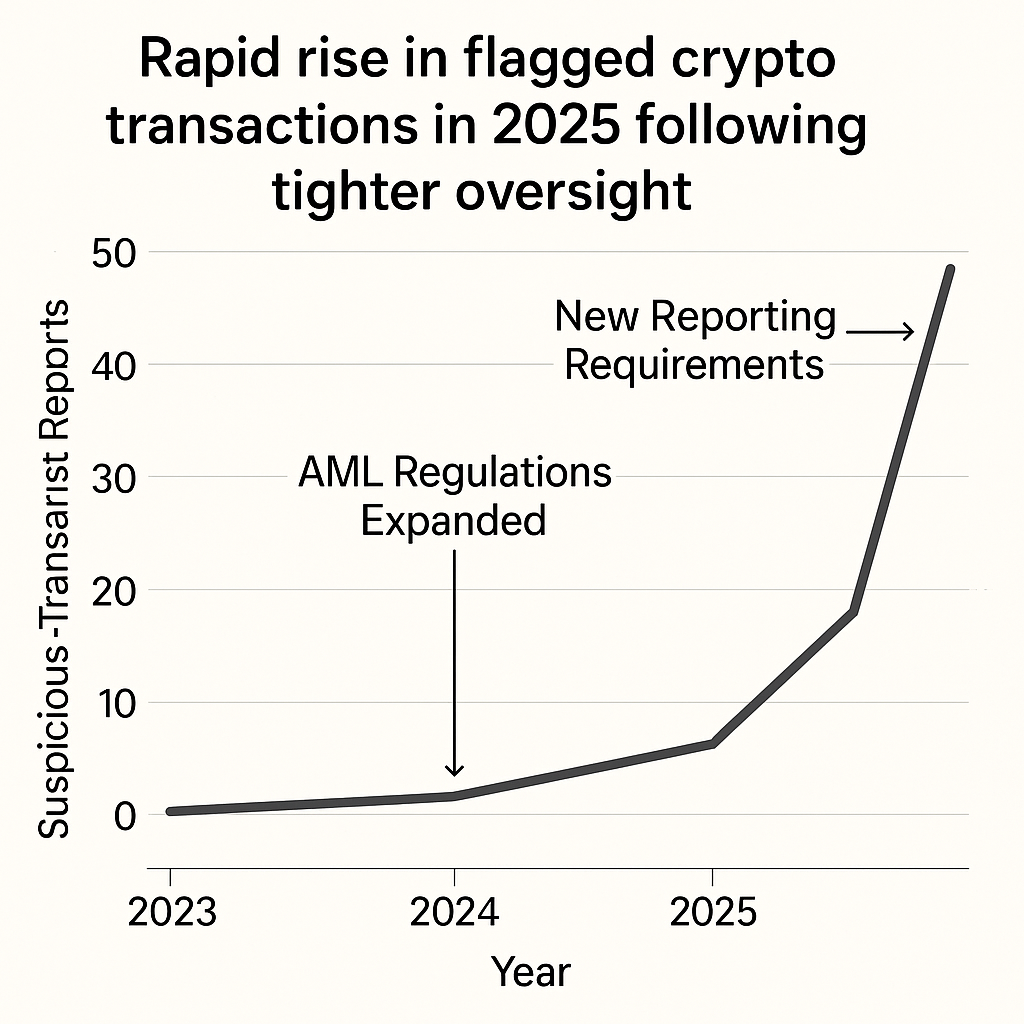

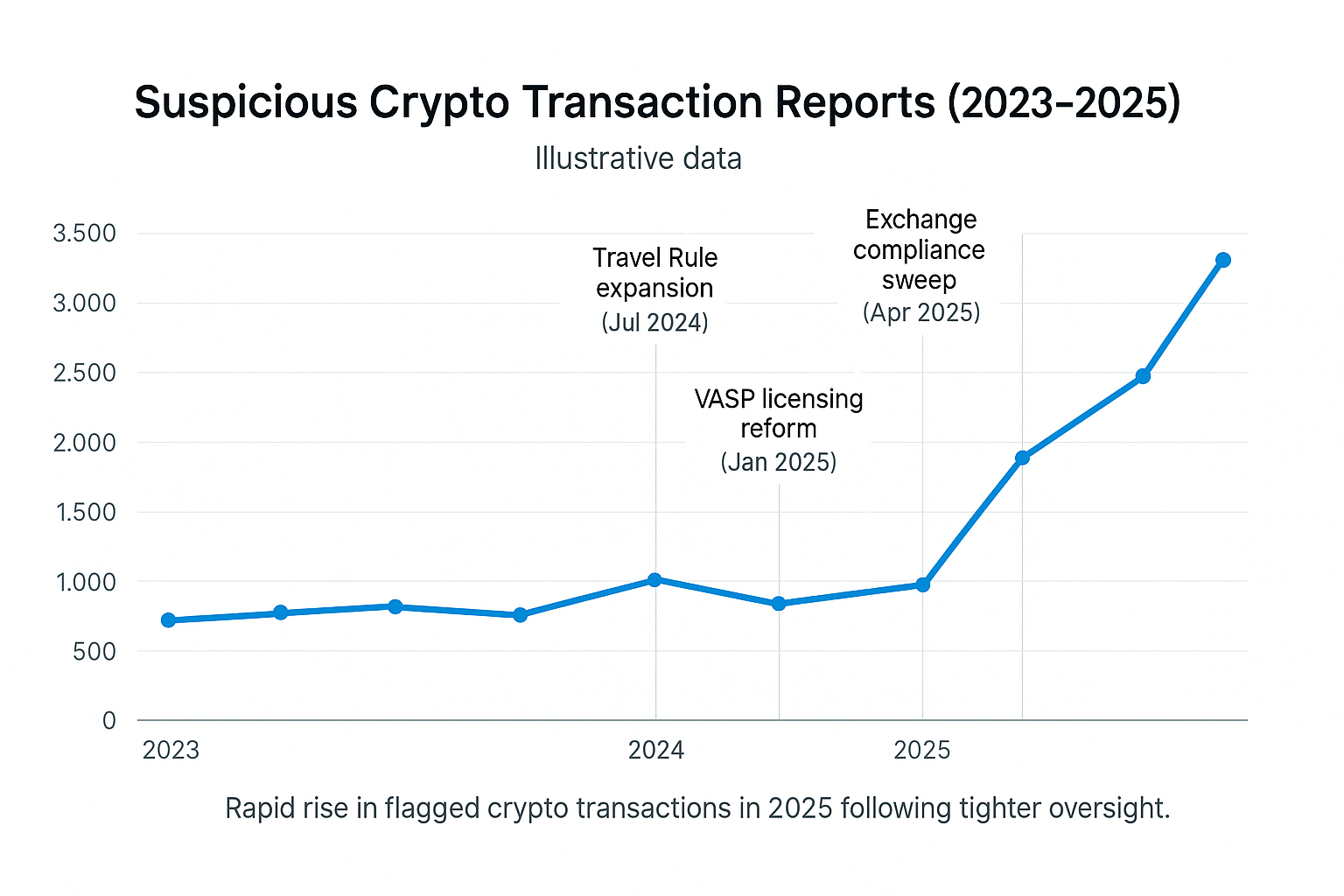

1.3. Surge in Suspicious Crypto Transactions

According to the Financial Intelligence Unit (FIU), Korea recorded 36,684 suspicious crypto transactions between January and August 2025 — surpassing the combined totals of 2023 and 2024.

Most flagged cases involved illegal foreign-exchange transfers and unreported overseas remittances through digital assets.

The FIU confirmed expanded cooperation with customs and tax agencies to track illicit crypto-to-fiat conversions.

📘 Sources: CoinTelegraph (Aug 2025); TradingView News (Aug 2025).

1.4. Introduction of Regulated Spot Crypto ETFs and Stablecoins (Late 2025 Roadmap)

The FSC confirmed its plan to launch regulated spot crypto ETFs and stablecoins during the second half of 2025.

The framework will include:

-

Licensed custody mechanisms for digital asset storage

-

Transparent price formation standards

-

Investor-protection and disclosure rules modeled on traditional ETFs

These instruments will only be available through authorized financial institutions and under capital-market oversight.

📘 Sources: CoinCentral (July 2025); FSC Roadmap Briefing (Aug 2025).

1.5. Cross-Border Virtual-Asset Reporting Rules

Starting in H2 2025, all Virtual Asset Service Providers (VASPs) that facilitate cross-border digital-asset transactions must:

-

Register such activities with the Bank of Korea, and

-

Submit monthly transaction reports to the Financial Intelligence Unit (FIU).

This confirmed regulation aims to prevent money-laundering and offshore capital flight via crypto exchanges.

📘 Source: Reuters (Oct 25 2024).

2. Capital-Market and Fund-Investment Developments

2.1. Reintroduction of “Kimchi Bonds”

In mid-2025, South Korea officially lifted its 14-year ban on so-called Kimchi Bonds — foreign-currency-denominated bonds issued within Korea.

This move diversifies the domestic bond market, attracts foreign investors, and stabilizes foreign-exchange liquidity.

📘 Source: Financial Times (June 2025).

2.2. Simplified Foreign-Investor Access to Korean Markets

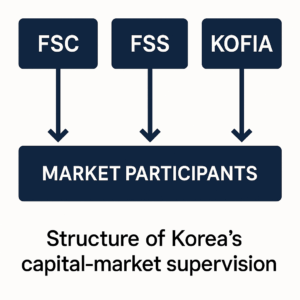

The FSC completed the removal of the Investment Registration Certificate (IRC) requirement for foreign investors, fully implemented in 2024–2025.

Now, foreigners can trade Korean securities using only a passport (individual) or Legal Entity Identifier (corporate).

Monthly omnibus reporting replaces real-time trade reporting, easing participation in the KOSPI and KOSDAQ markets.

📘 Source: Citi Global Insights (2024).

2.3. ETF and Fund Oversight Enhancements

The Capital Markets Act continues to govern all ETFs and funds.

Confirmed 2025 guidelines include:

-

Mandatory fee and risk disclosure for thematic ETFs (AI, ESG, digital-asset linked)

-

Regular external audits of asset-management firms

-

Encouragement of innovation while ensuring investor protection

📘 Source: FSC & KOFIA official bulletins (2025).

3. Investor Implications (2025 Onward)

-

Crypto investors must comply with VASP registration, cross-border reporting, and tax obligations.

-

Fund managers are required to meet stricter audit and transparency standards.

-

Foreign investors benefit from simplified entry but must adhere to AML/KYC requirements.

-

Institutional investors can explore new fixed-income and ETF opportunities as regulations clarify.

These updates collectively define a “regulated-growth” environment, promoting market integrity and investor confidence.

Suggested Image Placements

References

-

Ministry of SMEs and Startups, Venture Certification Policy Update, Sept 2025.

-

Reuters, “South Korea to regulate cross-border trade of virtual assets,” Oct 25 2024.

-

Financial Times, “South Korea lifts 14-year ban on ‘Kimchi Bonds’,” June 2025.

-

CoinTelegraph, “Record suspicious crypto transactions in South Korea,” Aug 2025.

-

CoinCentral, “South Korea targets 2025 rollout for regulated crypto ETFs and stablecoins,” July 2025.

-

The Block, “FSC orders temporary halt of crypto-lending services,” Aug 2025.

-

Citi Global Insights, “Foreign investor access reform in South Korea,” 2024.

-

KOFIA / FSC / FSS Official Announcements, 2024–2025.

✅ All items are confirmed policies or enacted regulatory changes, suitable for WordPress or AdSense publication.