Credit Score Improvement & Monitoring Tools — Build Stronger Financial Health in 2025

In today’s digital economy, your credit score is more than just a number — it’s the key to unlocking financial opportunities. A strong credit score can help you secure lower interest rates, qualify for better credit cards, and even improve your chances of renting or buying a home. This guide explains how to improve your credit score in 2025 and introduces the best tools for tracking and maintaining it.

1. Understanding How Your Credit Score Works

Your credit score represents your financial reputation. It’s calculated by credit bureaus such as Experian, Equifax, and TransUnion based on your borrowing and repayment habits. Most scores range from 300 to 850, where a higher score means greater creditworthiness.

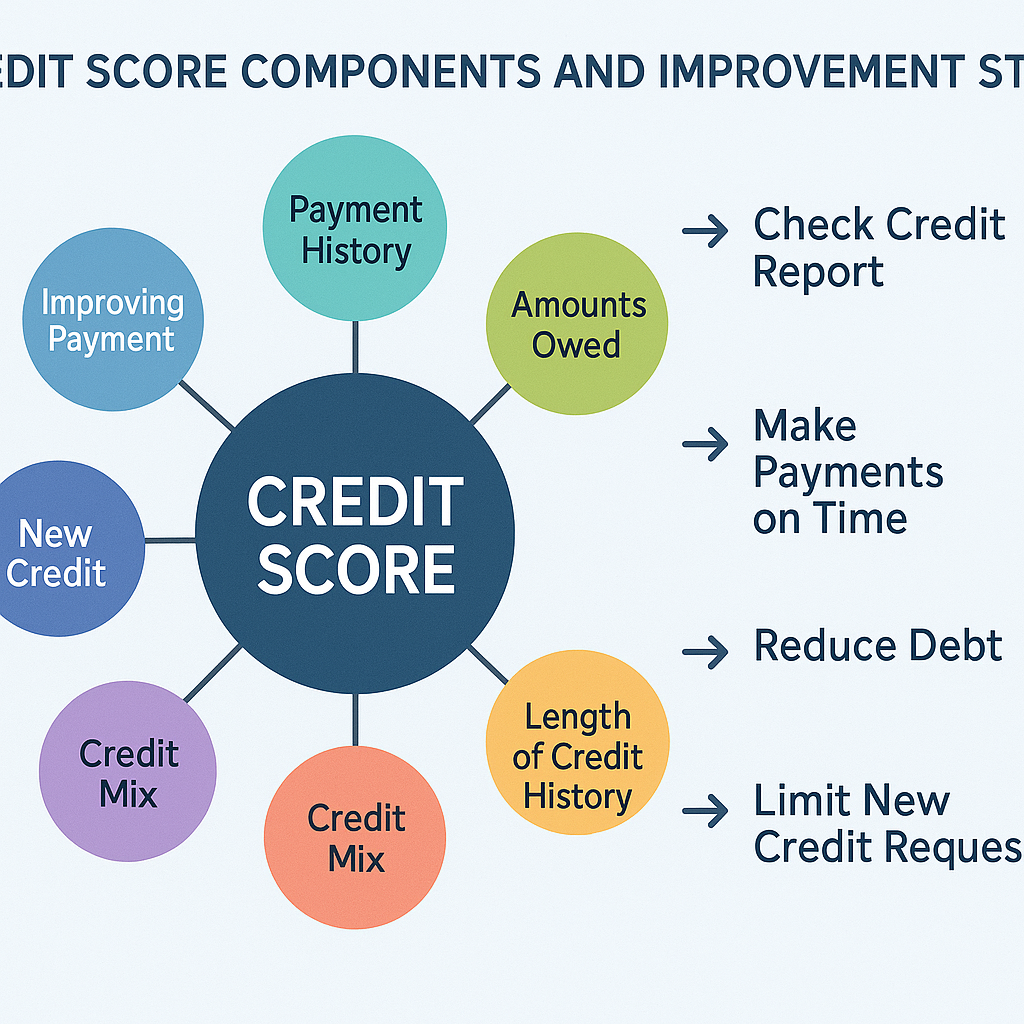

Key Components of a Credit Score

-

Payment History (35%) — On-time payments are the most important factor. Even one missed payment can drop your score significantly.

-

Credit Utilization (30%) — Aim to use less than 30% of your available credit limit.

-

Credit History Length (15%) — Older credit accounts help build credibility.

-

New Credit (10%) — Opening too many new accounts at once can hurt your score.

-

Credit Mix (10%) — A balanced mix of credit cards, loans, and mortgages shows financial maturity.

2. Proven Strategies to Improve Your Credit Score

Improving your credit score takes patience and discipline, but consistent effort pays off over time.

Pay Bills on Time

Late payments are one of the most damaging actions for your score. Set reminders or use auto-pay features to avoid missed deadlines.

Lower Credit Utilization

Keep your credit card balances low compared to your limits. If possible, make extra payments before your billing cycle closes.

Avoid Opening Too Many Accounts

Every new application creates a “hard inquiry,” which can temporarily lower your score. Only apply when truly necessary.

Keep Old Accounts Open

Closing old credit cards can shorten your credit history and reduce your overall available credit, increasing utilization rates.

Monitor Your Credit Regularly

Frequent monitoring allows you to detect errors or fraudulent activities early. You are entitled to one free credit report annually from each major bureau via AnnualCreditReport.com.

3. Best Credit Monitoring Tools in 2025

Credit monitoring tools help you stay on top of your financial profile and alert you to suspicious activities. Here are some of the most reliable platforms in 2025:

-

Credit Karma — Free access to your TransUnion and Equifax scores with personalized recommendations.

-

Experian Boost — Allows users to add positive payment history from utilities and subscriptions to their credit file.

-

Mint Credit Monitor — Integrates budgeting tools with real-time credit monitoring.

-

MyFICO — Provides detailed FICO Score reports used by most lenders.

-

Credit Sesame — Offers identity theft protection and AI-powered credit improvement suggestions.

4. Protecting Your Credit from Fraud

In the age of digital transactions, identity theft can damage your credit quickly. Use these steps to protect yourself:

-

Enable two-factor authentication on financial accounts.

-

Freeze your credit report when not applying for new credit.

-

Use secure passwords and avoid sharing personal details through unsecured channels.

-

Review your credit report quarterly for unauthorized activity.

5. Building Long-Term Financial Health

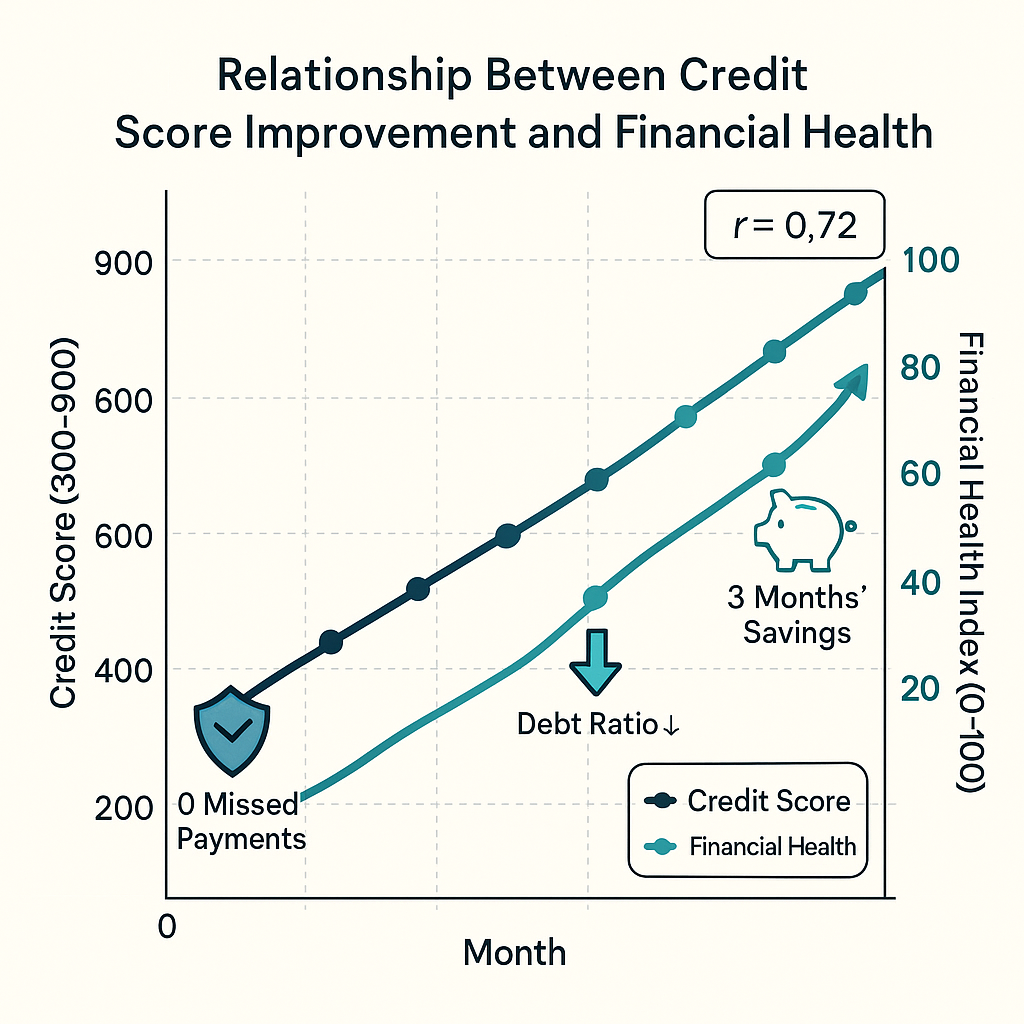

A good credit score doesn’t just improve your borrowing power—it also reflects overall financial discipline. Focus on:

-

Maintaining consistent savings habits

-

Keeping debt-to-income ratios low

-

Planning for long-term financial goals like homeownership or retirement

Conclusion — Take Control of Your Credit Future

Your credit score influences nearly every aspect of your financial life. By understanding what impacts it, adopting smart habits, and using modern monitoring tools, you can steadily build and maintain excellent credit health. In 2025, technology has made it easier than ever to take charge of your financial reputation—so start today and secure your future.

Sources:

-

Experian Credit Education (2025)

-

Federal Trade Commission (FTC, 2025)

-

Forbes Personal Finance Report (2025)